Do banks reuse account numbers? This in-depth exploration delves into the complex world of account number recycling practices, examining the procedures, regulations, and security implications surrounding this common banking procedure. Understanding the reasons behind reuse, the legal frameworks, and the potential risks is crucial for both banking institutions and customers alike.

Banks often reuse account numbers in various scenarios, such as after account closures or mergers. This practice, while sometimes necessary for operational efficiency, raises concerns about potential security breaches and customer data privacy. This analysis will provide a comprehensive overview of the topic, shedding light on the intricacies involved.

Account Number Recycling Practices

Banks aren’t just handing out random numbers. They have a meticulous process for assigning and reusing account numbers to ensure efficiency and maintain a consistent system. This process, while often invisible to customers, plays a crucial role in the smooth functioning of the banking system. Understanding these practices helps you appreciate the complexities behind your banking experience.The process of assigning and reusing account numbers is a carefully controlled system designed to optimize resources and maintain a consistent level of service.

This involves a combination of data management, security protocols, and regulatory compliance. This approach ensures that account numbers are utilized effectively while protecting sensitive financial information.

Account Number Assignment Process

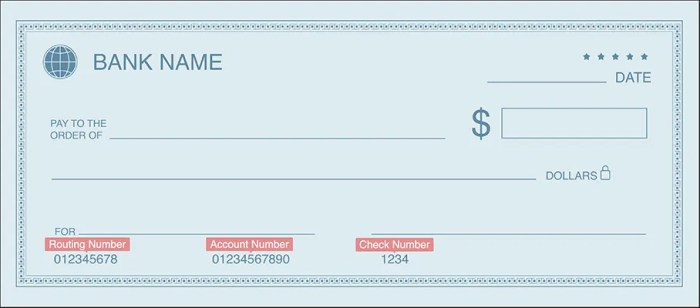

Banks typically use a combination of algorithms and pre-assigned number sequences for new account creation. These systems are designed to prevent duplication and ensure unique identification for each account. A central database, often with redundancy for data security, tracks available account numbers.

Account Number Reuse Scenarios

Account numbers are reused in various circumstances, primarily when an account is closed or when banks merge. For example, if a customer closes an account, the associated account number is flagged as available. The system then identifies and reassigns this number to a new account, ensuring the number is used efficiently. Similarly, during mergers, banks often reassign account numbers to maintain a consistent system for customers of the merged entities.

Banks generally don’t reuse account numbers, it’s a pretty secure system. If you’re looking for a tasty pizza, check out Wilmington House of Pizza in Wilmington, MA, here. They’ve got great reviews, and hopefully, their account numbers are also unique! So, to recap, banks are pretty good at keeping your account number safe and sound.

This often involves a complex data migration process to ensure the correct mapping of account numbers to customers.

Banks generally don’t reuse account numbers, it’s a pretty standard practice. They typically assign new ones, especially for security reasons. This is important to consider, especially when looking at historical financial records, like those connected to the Four Freedoms House of Phila, Philadelphia PA four freedoms house of phila philadelphia pa. Knowing this helps you understand the integrity of financial information.

So, the short answer is, no, banks usually don’t reuse account numbers.

Determining Account Number Availability, Do banks reuse account numbers

A dedicated system is in place to check the availability of account numbers. This involves querying the central database, checking for existing allocations, and ensuring the number hasn’t been flagged for other reasons, such as fraud or dispute. The system is designed to ensure that the process is quick and efficient while maintaining accuracy and security.

Reuse Practices Across Banking Systems

Banks employ various approaches for handling account number reuse depending on their specific systems and technologies. Some banks might use a centralized system for all account numbers, while others might have separate systems for different product lines (checking, savings, etc.). Regardless of the system, a standard protocol is typically used to ensure consistency and data integrity across the entire network.

This often involves stringent validation procedures to ensure that account numbers are used correctly.

Account Number Reuse Policies by Account Type

| Account Type | Reuse Policy |

|---|---|

| Checking Account | Account numbers are generally reused after a closure period, ensuring a reasonable time for any potential discrepancies or claims. |

| Savings Account | Similar to checking accounts, but with additional checks for associated loans or other linked financial products. |

| Credit Card Account | Reuse policies are stricter, often involving a more extended period before the number is available for reassignment to prevent fraud. |

| Loan Account | Reuse policies are specific to each loan type and the terms of the loan agreement. Generally, a specific timeframe or conditions must be met before the account number can be reassigned. |

Legal and Regulatory Framework: Do Banks Reuse Account Numbers

The reuse of account numbers isn’t a free-for-all. Different countries and regions have strict regulations surrounding account number recycling to protect consumers and maintain financial stability. Understanding these rules is crucial for banks operating internationally or simply wanting to avoid hefty fines.Regulations regarding account number reuse vary significantly across jurisdictions, often mirroring their broader financial legislation. This complexity stems from the need to balance the efficiency of account number management with the need to safeguard customer information and prevent fraud.

Regulations Governing Account Number Reuse

Different countries and regions have implemented specific regulations regarding account number reuse, often as part of broader financial legislation. These regulations aim to maintain financial stability, protect consumers, and prevent fraud.

- European Union (EU): The EU’s directives on financial services often dictate account number reuse policies. These directives often Artikel strict guidelines on how banks can manage and reuse account numbers, focusing on the protection of customer data and preventing fraud. A prime example is the GDPR, which significantly impacts data handling practices across the EU, including account numbers.

- United States (US): The US does not have a single, unified federal law on account number reuse. Instead, regulations are often specific to individual states or financial institutions, potentially leading to inconsistencies. Different banking regulations across states influence how account numbers are reused.

- United Kingdom (UK): The UK’s regulatory landscape for account numbers and financial services generally follows EU principles and directives. The Financial Conduct Authority (FCA) plays a significant role in overseeing financial institutions and enforcing regulations related to account number reuse.

Implications of Non-Compliance

Non-compliance with account number reuse regulations carries significant implications for banks. Failing to adhere to these rules can result in substantial financial penalties, reputational damage, and legal repercussions.

- Financial Penalties: Fines can range from relatively small amounts to substantial sums, depending on the severity of the violation and the regulatory body. These penalties are designed to deter non-compliance and encourage adherence to the regulations. For example, a bank in the US violating state-level regulations might face fines, whereas a European bank violating EU directives could face much larger fines.

- Reputational Damage: Public exposure of non-compliance can significantly harm a bank’s reputation. This reputational damage can result in decreased customer trust, difficulty attracting new clients, and loss of market share.

- Legal Action: Non-compliance can lead to legal action, potentially including lawsuits from affected customers or regulatory bodies. These lawsuits can lead to costly legal battles and potential financial losses.

Comparison of Reuse Policies Across Regions

Comparing account number reuse policies across various regions reveals significant variations in regulations. This difference highlights the need for banks to be well-versed in the specific requirements of each jurisdiction where they operate.

| Region | Legal Framework | Restrictions |

|---|---|---|

| EU | Directive-based, focused on data protection | Strict reuse rules; emphasis on customer data security |

| US | State-specific, often varying | Less unified framework; may involve complex compliance efforts |

| UK | Following EU principles and directives | Strict guidelines mirroring EU standards; FCA oversight |

Potential Penalties for Violations

Banks that violate account number reuse regulations face a range of potential penalties, tailored to the specific nature of the violation and the regulatory body involved.

Penalties can include significant fines, legal action, and reputational damage, all impacting a bank’s financial standing and operational efficiency.

These penalties act as a deterrent and are designed to ensure banks comply with the regulations governing account number reuse. For instance, a US bank might face state-specific penalties for failing to adhere to a specific state’s account number reuse rules, whereas an EU bank could face significant fines under EU directives.

Technical Aspects of Reuse

Banks aren’t just throwing account numbers into a blender and hoping for the best. Behind the scenes, sophisticated systems are in place to track and manage these numbers, preventing chaos and ensuring smooth operations. Understanding these technical intricacies is crucial for evaluating the overall safety and efficiency of account number reuse practices.

Account Number Tracking and Management Systems

Banks employ a variety of technical systems to monitor and manage account numbers. These systems are often integrated into core banking systems, ensuring seamless data flow and real-time updates. Sophisticated databases store information about account numbers, including their current status, usage history, and any associated restrictions. This allows banks to quickly identify and track account numbers throughout their lifecycle.

They also employ complex algorithms to manage the allocation and assignment of new numbers.

Conflict Prevention and Duplication Avoidance

Preventing conflicts and duplications is paramount in account number reuse. Banks employ robust algorithms and data validation procedures to ensure that a new account number is unique and not already in use. This usually involves comparing the new number against a comprehensive database of existing account numbers. Advanced techniques, such as hashing algorithms and checksums, further enhance the accuracy and reliability of the validation process.

This meticulous approach guarantees that no two accounts have the same number, preventing potential confusion and errors.

Account Number Availability Verification

Verifying the availability of an account number is a critical step in the reuse process. Banks utilize dedicated software and APIs to check if a particular number is free for assignment. This verification often involves a real-time lookup within the central database to ensure the number is not in use. The system must be designed to handle high volumes of requests efficiently and accurately.

Security Risks Associated with Reuse

While account number reuse can be beneficial, it also presents potential security risks. Careless implementation or inadequate security measures can compromise the safety of customer data. Potential risks include unauthorized access to accounts, fraud, and identity theft. Robust security protocols, including encryption and access controls, are essential to mitigate these risks. Regular security audits and vulnerability assessments are crucial to maintain a secure environment.

Technical Approaches to Manage Account Number Reuse

Different approaches exist to manage account number reuse, each with its own strengths and weaknesses.

| Technical Approach | Pros | Cons |

|---|---|---|

| Centralized Database with Real-time Verification | Ensures uniqueness and prevents conflicts. High availability of information. | Potential single point of failure if the database is compromised. |

| Distributed Ledger Technology (DLT) | Enhanced security and transparency through distributed verification. Immutable records reduce fraud risk. | Implementation complexity and potential scalability issues. High initial investment cost. |

| Hashing and Checksum Algorithms | High efficiency in verifying uniqueness. Simple to implement. | Less secure against sophisticated attacks compared to encryption methods. |

Customer Impact and Implications

So, banks are reusing account numbers. Big deal, right? Wrong. This impacts customers more than you might think. It’s not just about the numbers; it’s about trust, security, and the overall banking experience.

Let’s dive into how account number reuse affects customers and what banks can do about it.This section will examine the customer perspective on account number reuse, including the benefits and drawbacks. We’ll also delve into how these practices affect data security and privacy, and analyze different customer service strategies employed by banks to manage these issues. Crucially, we’ll discuss the importance of transparent communication with customers regarding this practice.

Customer Experience Impacts

Account number reuse can significantly impact the customer experience. A seamless and intuitive process is paramount. Customers should be able to easily access their accounts and perform transactions without confusion or frustration. However, if not handled properly, the reuse of account numbers can lead to significant user experience problems. For instance, a customer might mistakenly believe they are interacting with a different account than intended, which could result in errors and lost funds.

A well-designed system for managing reused account numbers is critical for maintaining a positive customer experience.

Benefits of Reusing Account Numbers (Customer Perspective)

From a customer perspective, the benefits of reusing account numbers are largely indirect and often outweigh the drawbacks in the long run. Banks might argue that it’s more cost-effective and efficient. This can lead to lower operational costs, which can translate into lower fees for customers. Furthermore, reuse can potentially streamline account opening and maintenance processes, allowing banks to process transactions more quickly and effectively.

However, these advantages must be weighed against the potential drawbacks for the customer experience.

Drawbacks of Reusing Account Numbers (Customer Perspective)

Conversely, the drawbacks of reusing account numbers are more immediate and impactful for the customer. Confusion is a primary concern. Customers might experience difficulty distinguishing between different accounts, leading to errors in transactions and potentially impacting their financial well-being. Furthermore, the perception of security can be compromised. If not managed carefully, the reuse of account numbers can lead to a loss of trust.

Impact on Data Security and Privacy

Account number reuse policies directly affect customer data security and privacy. If not implemented correctly, the reuse of account numbers could create vulnerabilities. For instance, improper management of reused numbers could expose sensitive customer data to potential breaches. This is why a robust security framework is crucial. Banks must ensure that data encryption and access controls are implemented appropriately to safeguard customer information.

Customer Service Strategies

Different banks employ various customer service strategies to address the implications of reused account numbers. Some banks focus on providing comprehensive account information to customers, while others prioritize proactive communication to avoid potential issues. For example, some banks may send automated alerts or reminders to customers regarding account changes, including those associated with account number reuse.

Transparent Communication

Transparent communication with customers regarding account number reuse is critical. Banks should clearly explain their policies and procedures, outlining how account numbers are reused and the potential implications for customers. This includes providing accessible and user-friendly resources that explain the policies and answer common questions. This transparency fosters trust and ensures that customers understand the bank’s practices.

Security Considerations

Banks are constantly under pressure to improve security. Reusing account numbers adds a layer of complexity, demanding a proactive approach to safeguarding customer data. This section delves into the robust security measures banks employ to mitigate risks associated with account number recycling.Implementing secure protocols for account number reuse is crucial. These protocols must be meticulously designed and rigorously tested to prevent fraud and data breaches.

Security measures are not a one-time fix; they need ongoing evaluation and adaptation to emerging threats.

Security Measures Implemented by Banks

Banks employ a multifaceted approach to securing reused account numbers. This includes robust authentication protocols, enhanced data encryption, and stringent access controls. These measures are designed to deter unauthorized access and maintain the confidentiality of customer data. The specific measures depend on the bank’s size, structure, and the nature of the account number reuse process.

Identity Verification Protocols

Thorough identity verification is paramount when assigning reused account numbers. Banks employ multi-factor authentication (MFA) to confirm customer identity, reducing the risk of fraudulent account creations. This typically involves a combination of factors such as password, one-time codes, biometrics, or security questions. These protocols are designed to make it extremely difficult for unauthorized individuals to gain access to accounts.

Impact on Existing Security Systems

Reusing account numbers necessitates modifications to existing security systems. These modifications might include adjustments to account creation processes, enhanced monitoring of suspicious activity, and improved fraud detection algorithms. Banks need to adapt their systems to account for the reuse of account numbers, ensuring existing safeguards remain effective in this new environment.

Security Protocols for Managing Reused Account Numbers

| Security Protocol | Description | Effectiveness |

|---|---|---|

| Multi-Factor Authentication (MFA) | Utilizes multiple authentication methods to verify identity. | High – Significantly reduces unauthorized access. |

| Advanced Encryption Techniques | Securely encrypt sensitive data associated with the account number. | High – Protects data in transit and at rest. |

| Real-time Monitoring Systems | Continuously track account activity for suspicious patterns. | Medium – Effective for detecting anomalies, but requires careful tuning. |

| Regular Security Audits | Periodic review of security protocols and systems for vulnerabilities. | High – Proactive approach to identify and address weaknesses. |

Robust security protocols, including those listed above, are essential for mitigating the risks associated with account number reuse.

Potential Risks of Inadequate Security Measures

A lack of robust security measures can expose customers to significant risks, including identity theft, financial fraud, and reputational damage for the bank. Account takeovers, unauthorized transactions, and data breaches are all potential consequences of insufficient security protocols in the account number reuse process. The financial and reputational costs of such incidents can be substantial. For example, a major bank that fails to adequately secure reused account numbers could face significant fines and loss of customer trust, impacting its market position.

Practical Implications and Best Practices

So, banks are considering reusing account numbers? That’s a big deal, and it’s not just about saving space on servers. It impacts everything from operational efficiency to customer trust. We’ll dive into the practical implications, best practices, and strategies for a smooth transition. Let’s get real about how banks can handle this effectively.Understanding the potential ripple effects of account number reuse is crucial for any bank.

It’s not just a technical exercise; it’s about managing customer expectations, maintaining operational integrity, and avoiding potential security breaches. Implementing the right strategies will determine the success of this process.

Operational Implications of Account Number Reuse

Banks need to meticulously plan how reusing account numbers affects various departments. Account management, fraud prevention, and customer service all need tailored procedures. Inaccurate data handling or insufficient training can lead to customer service issues, creating a negative experience. For example, if the system isn’t updated properly, customers might receive statements for the wrong accounts, leading to confusion and frustration.

Best Practices for Minimizing Risks

A robust strategy for account number reuse needs careful planning. It’s not just about technical updates; it’s about a comprehensive approach that addresses operational changes, security measures, and customer communication. This requires a multi-faceted approach, focusing on security, customer experience, and efficiency.

- Comprehensive Risk Assessment: A thorough risk assessment is paramount. Banks need to identify potential vulnerabilities in their systems and processes, especially those related to fraud, data breaches, and customer confusion. They should consider scenarios like how a reused account number might be exploited or how the change will impact their existing systems and processes.

- Phased Implementation: Instead of a complete overhaul, implementing account number reuse in phases can reduce the risk of widespread problems. Start with a limited group of accounts, monitor the results, and gradually expand the reuse process. This approach allows banks to identify and address any unexpected issues before they impact a larger customer base.

- Enhanced Security Protocols: Strengthening security protocols is crucial. Consider implementing more robust authentication methods, enhancing fraud detection systems, and ensuring data encryption throughout the reuse process. This will help minimize the risk of unauthorized access and financial fraud.

- Improved Customer Communication: Transparent communication with customers is essential. Inform them about the account number reuse policy, provide clear explanations, and answer their questions promptly. This proactive approach will help manage customer expectations and build trust.

Strategies for Handling Account Number Reuse in Different Scenarios

Different scenarios require different strategies. A bank with a large customer base might need a different approach compared to a smaller institution. The strategies should be customized to the specific needs and circumstances.

- Migrating Existing Accounts: This involves transferring existing account data to new account numbers while ensuring data integrity. Banks need a clear process for handling this migration, ensuring all relevant information is accurately transferred. This might involve updating account records, generating new statements, and communicating the changes to customers.

- Opening New Accounts: In situations where new accounts are being created, assigning reused account numbers requires a structured approach. This should be done in a way that maintains consistency, minimizes confusion, and ensures security.

- Mergers and Acquisitions: During mergers or acquisitions, the reuse of account numbers requires careful consideration to avoid any issues. Banks should follow strict guidelines to ensure smooth integration and maintain customer data integrity.

Improving Efficiency of the Reuse Process

Implementing automation tools and streamlining workflows can significantly improve the efficiency of the reuse process. Automating tasks like data migration and report generation will save time and reduce the risk of errors.

- Automation Tools: Leveraging automation tools for tasks like data migration and report generation can greatly improve efficiency. This reduces manual intervention, minimizes errors, and speeds up the process. For example, using software to automatically update customer records will save time and reduce the risk of mistakes.

- Workflow Optimization: Optimizing workflows can lead to substantial gains in efficiency. Banks should analyze existing processes and identify areas for improvement, creating a streamlined workflow to handle the account number reuse process.

Customer Education on Account Number Reuse

Educating customers about the process is essential for maintaining trust and minimizing confusion. Clear communication about the reasons behind the reuse and the benefits will help customers understand and accept the change. The key is to present the information in a clear and understandable way.

- Clear Communication Channels: Use multiple channels for communicating with customers, such as email, SMS, and letters. Ensure the language used is clear, concise, and easily understood. For example, providing a FAQ section on the bank’s website can be a valuable resource for customers.

- Customer Support Training: Customer support representatives need to be well-trained on the new process. They should be equipped to answer customer questions and address any concerns promptly. This will ensure that customers receive the support they need during the transition period.

Closing Notes

In conclusion, the practice of reusing account numbers by banks is a multifaceted issue. While operational efficiencies can be gained, the potential for security risks and customer concerns necessitate robust procedures, stringent regulations, and transparent communication. The interplay of technical systems, legal frameworks, and customer impact are critical components in ensuring responsible and secure account number reuse.

Question & Answer Hub

What are the common reasons why banks might reuse account numbers?

Account closures, mergers, and acquisitions are common triggers for account number reuse. Banks may also reuse numbers to streamline operations and maintain efficiency.

How do banks ensure the security of reused account numbers?

Robust security measures, including verification protocols and enhanced security systems, are implemented to mitigate the risks associated with reused account numbers. These measures are designed to protect customer data and prevent unauthorized access.

Are there any legal restrictions on reusing account numbers?

Regulations governing account number reuse vary by jurisdiction. Banks must comply with these regulations to avoid penalties and maintain operational compliance.

How does account number reuse impact customer experience?

Transparent communication with customers about reuse policies and procedures is crucial to minimize potential confusion and concerns. Effective customer service strategies play a significant role in managing customer expectations.