With d is the policyowner and insured for a 50000, a world of protection unfolds, a tapestry woven with threads of coverage, financial implications, and legal considerations. This policy, a beacon in the storm of life’s uncertainties, promises a safety net of 50000, a shield against unforeseen events. Explore the intricacies of this policy, where the role of the policyholder takes center stage, shaping the contours of coverage and financial security.

This comprehensive guide delves into the specifics of the policy, from its detailed coverage to the intricate claims process. Understanding the nuances of this policy, tailored for d as both policyowner and insured, is key to maximizing its benefits and navigating its complexities.

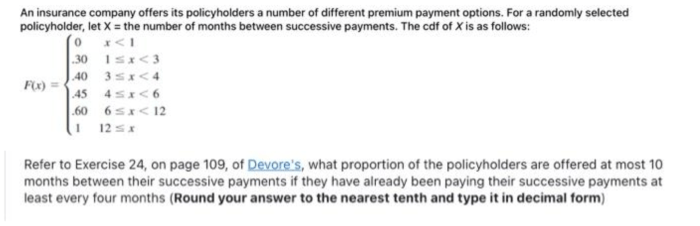

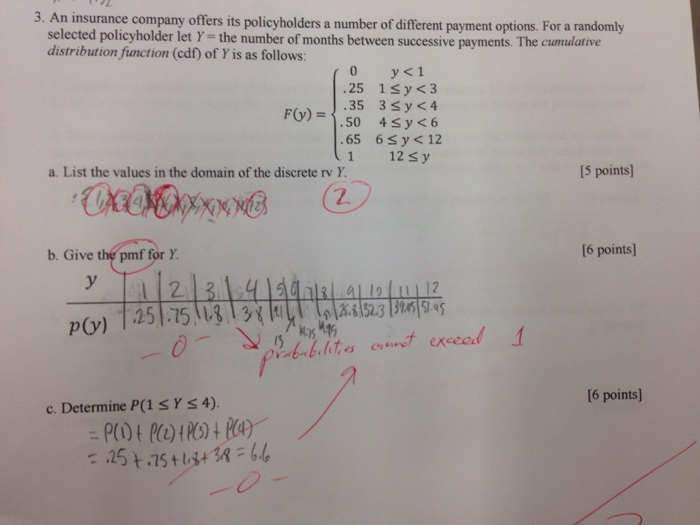

Policy Details

This section details the comprehensive coverage of the policy, outlining terms, conditions, benefits, and limitations. Understanding these aspects is crucial for the policyholder, particularly given their dual role as policyowner and insured.The policy, with a maximum coverage amount of $50,000, is designed to provide financial protection against specific risks. Specific details, including the policy’s type, insured parties, and coverage amounts, are elaborated below.

Policy Coverage

The policy covers a range of potential events. Coverage is not absolute and is subject to specific terms and conditions Artikeld in the policy document. Understanding these parameters is paramount for appropriate claim management and to avoid potential disputes.

- The policy encompasses standard liability protections, such as bodily injury and property damage. This coverage typically applies when the policyholder’s actions or omissions lead to harm to others or their property.

- The policy likely includes a specific limit for each type of coverage, meaning that there is a maximum amount that will be paid out for any given event.

- The policy’s coverage may be subject to deductibles and/or co-pays. This portion of the claim amount must be met by the policyholder before the insurer pays out any funds.

Policy Terms and Conditions

These are crucial components that govern the policy’s application and implementation. These elements define the rights and responsibilities of both the policyholder and the insurer.

- Policy duration and renewal options are vital aspects of the agreement. Policies typically have specific terms, often annually renewable. Details about the renewal process, including notification periods and any additional fees, should be explicitly Artikeld.

- Policy exclusions are critical for understanding what situations are not covered. These clauses are usually listed explicitly in the policy documents. Understanding exclusions helps the policyholder avoid unnecessary claims and ensures realistic expectations.

- Policy claims procedures are Artikeld to ensure efficient processing and prevent potential delays or complications. The policyholder should understand the step-by-step process for filing a claim.

Policy Benefits and Limitations

Understanding the advantages and disadvantages of the policy is key to making an informed decision.

Given that D is the policyowner and insured for a $50,000 policy, comprehensive home care services like those offered by Griswold home care for Cincinnati become a critical component of assessing potential healthcare needs and associated costs. The policy’s coverage limitations necessitate a thorough understanding of alternative support structures for maintaining D’s well-being, ensuring a comprehensive approach to healthcare management.

- The policy’s benefits provide financial protection against potential losses or damages. The financial cushion is vital for recovering from unforeseen events.

- Limitations are defined by the coverage amount and specific exclusions. The coverage amount of $50,000 is a crucial aspect, as it defines the upper limit of compensation.

- Benefits are tied to specific criteria and terms. The policy will have detailed guidelines that dictate the specific situations where coverage applies.

Impact of Dual Role (Policyowner and Insured)

Since the policyholder is both the owner and insured, the policy’s coverage and claims process are subject to the terms of the contract. The policy’s provisions are legally binding and must be adhered to by both parties.

- The policyholder’s actions as both policyowner and insured will influence coverage in various ways, impacting the interpretation and application of policy terms and conditions.

Key Policy Details, D is the policyowner and insured for a 50000

This table summarizes the key aspects of the policy.

| Coverage Type | Coverage Amount | Insured Parties |

|---|---|---|

| Liability (Bodily Injury/Property Damage) | $50,000 | D (Policyowner and Insured) |

Financial Implications

The financial implications of a policy with a 50,000 insured amount are multifaceted and critical for understanding the policy’s value proposition. This section delves into premium structures, potential payouts, risk management strategies, and the impact of claims on the policyholder’s financial well-being.Understanding the financial aspects of the policy is crucial for informed decision-making. The premium costs, payout potential, and the role of the policy in managing risk are integral to evaluating the policy’s overall financial suitability.

Premium Payments

Premium payments are a crucial element of the policy’s financial structure. They represent the cost of insurance coverage and vary based on factors such as the policy type, insured amount, and the policy’s coverage scope. The premiums are often determined using actuarial models that assess risk and project potential claims. Premiums are paid periodically, typically monthly or annually.

For example, a standard health insurance policy with a 50,000 coverage amount might require a monthly premium of $100-$300, depending on the specifics of the policy.

Potential Payouts

The potential payouts associated with a policy are determined by the terms and conditions Artikeld in the policy document. Payouts can be triggered by various events, such as death, disability, or specific medical expenses. The payout amount is directly linked to the insured amount and the specifics of the claim. For instance, a life insurance policy with a 50,000 insured amount would likely pay out the full 50,000 in the event of death.

Conversely, a health insurance policy might pay out a portion of the insured amount, depending on the specific expenses covered.

Policy’s Role in Risk Management

Insurance policies are fundamental tools in risk management. They transfer the financial burden of unforeseen events, such as illness or death, to the insurance company. The policyholder, in exchange for premium payments, gains protection against financial losses. This protection acts as a buffer against unforeseen circumstances, offering a safety net in challenging times. The 50,000 insured amount in this policy represents the maximum potential payout to mitigate the financial impact of a covered event.

Impact of Claims on Financial Situation

Claims can have a significant impact on the policyholder’s financial situation. A claim payout can provide much-needed financial relief, mitigating the financial burden of a covered event. Conversely, premium payments, especially in the case of a large claim, could potentially increase financial strain. The specific impact will depend on the nature of the claim, the policy’s coverage details, and the policyholder’s existing financial resources.

For example, a substantial medical claim might necessitate significant premium adjustments in the future.

Comparison of Policy Options

The following table provides a simplified comparison of different policy types, highlighting their premium costs and potential payouts. It is crucial to understand that this is a simplified representation and specific details vary widely.

| Policy Type | Premium | Potential Payout |

|---|---|---|

| Term Life Insurance | $50-$200/month | $50,000 |

| Whole Life Insurance | $100-$400/month | $50,000 (variable based on policy details) |

| Health Insurance | $100-$300/month | Variable (depending on covered expenses) |

Legal Considerations

Being both the policyowner and insured for a $50,000 policy carries specific legal implications. Understanding these ramifications is crucial for ensuring the policy’s proper execution and to avoid potential disputes. This section delves into the legal responsibilities, potential issues, and governing frameworks related to this dual role.

Legal Ramifications of Dual Policyowner and Insured Status

The policyowner, being both the policyholder and the individual covered by the insurance, has a complex legal position. The policyowner’s actions and knowledge directly affect the validity and enforceability of the policy. This dual role creates a unique set of responsibilities and potential liabilities.

Responsibilities of the Policyowner

The policyowner holds a significant responsibility in maintaining the policy’s integrity and ensuring its proper functioning. This includes accurate representation of the insured’s information, prompt payment of premiums, and adherence to the policy terms and conditions. Failure to fulfill these responsibilities could jeopardize the policy’s validity or lead to claims denial.

Potential Legal Issues

Several legal issues can arise from the dual role of policyowner and insured. These issues can involve misrepresentation of facts, non-payment of premiums, or disputes over claim settlement. Furthermore, issues regarding the policy’s coverage or exclusions can emerge if the policyowner does not fully understand or abide by the policy’s terms.

Legal Framework Governing the Policy

The legal framework governing the insurance policy varies depending on the jurisdiction. State laws and regulations, along with the specific policy terms, define the rights and obligations of both the policyowner and the insurer. This framework aims to protect the interests of all parties involved and ensure fairness in the insurance process.

Common Legal Issues Related to Policyownership and Insured Status

| Issue | Description | Solution |

|---|---|---|

| Misrepresentation of Facts | Providing inaccurate or misleading information during the application process, potentially leading to policy denial or claim rejection. | Ensure accurate and complete disclosure of all relevant information during the application process. Consult with a legal professional for advice on proper representation. |

| Non-Payment of Premiums | Failure to make timely premium payments, resulting in policy lapse and loss of coverage. | Establish a payment plan with the insurance company or explore alternative payment methods to maintain consistent premium payments. |

| Dispute over Claim Settlement | Disagreements between the policyowner (as insured) and the insurance company regarding the validity or amount of a claim. | Thoroughly document all aspects of the claim, including supporting evidence. Seek legal counsel for guidance on navigating the dispute resolution process. |

| Policy Coverage Disputes | Disagreements on the extent of coverage provided by the policy. | Review the policy terms and conditions thoroughly to understand the specific coverage. Consult with legal counsel to clarify any ambiguities. |

Insurance Types

Choosing the right insurance type is crucial for a comprehensive risk management strategy. Understanding the various options available and their specific characteristics allows for informed decisions that align with individual needs and financial situations. A well-structured insurance portfolio can provide peace of mind, protect assets, and potentially generate financial stability.

Different Insurance Types

Different insurance types cater to varying needs and risks. Understanding these nuances is essential for selecting the appropriate policies. Insurance products are not one-size-fits-all solutions, and the best option depends on the particular circumstances of the policyholder.

Health Insurance

Health insurance plans cover medical expenses, including doctor visits, hospital stays, and prescription drugs. Premiums and coverage levels vary significantly depending on the plan. A crucial aspect of health insurance is the out-of-pocket maximum, which sets a limit on the total amount an individual is responsible for paying in a given year. For a $50,000 coverage amount, a comprehensive health insurance policy that includes a high deductible plan with a health savings account (HSA) may be a viable option.

This approach allows for significant cost savings and promotes proactive health management.

Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. There are various types of life insurance, including term life and whole life insurance. Term life insurance offers coverage for a specific period, while whole life insurance provides coverage for the policyholder’s entire life. A $50,000 life insurance policy might be suitable for a young professional with limited dependents or as a supplemental policy to an existing larger coverage.

Disability Insurance

Disability insurance replaces lost income if an individual becomes unable to work due to illness or injury. It offers financial security in unforeseen circumstances, providing a crucial safety net. A $50,000 disability policy might be suitable for someone with limited savings or high debts, or as a supplement to other income sources.

Property Insurance

Property insurance protects against financial losses from damage or destruction of property. Policies cover various risks, including fire, theft, and natural disasters. For a $50,000 coverage amount, property insurance might cover personal belongings, potentially including a vehicle, in a comprehensive plan.

Liability Insurance

Liability insurance protects against financial responsibility for damages or injuries caused to others. It provides a financial safeguard against potential lawsuits or claims. A $50,000 liability policy may cover basic legal obligations, though more comprehensive coverage might be needed in specific situations, such as a business owner.

Comparison Table of Insurance Types

| Insurance Type | Coverage | Benefits | Limitations |

|---|---|---|---|

| Health Insurance | Medical expenses | Financial protection during illness/injury | Varying premiums and coverage levels |

| Life Insurance | Financial support for beneficiaries | Peace of mind in the event of death | Premiums and coverage vary widely |

| Disability Insurance | Income replacement in case of disability | Financial stability during prolonged illness | Policy specifics determine coverage duration |

| Property Insurance | Protection against property damage | Financial compensation for loss or damage | Specific exclusions and limitations exist |

| Liability Insurance | Protection against financial responsibility for others | Mitigation of potential legal liabilities | Coverage limits and policy exclusions vary |

Claims Procedures

The claims process Artikels the steps involved in submitting and resolving a claim under the insurance policy. A well-defined procedure ensures a smooth and efficient process for both the policyholder and the insurance provider. Adherence to these procedures is critical to avoiding delays and potential disputes.

Claim Initiation

Initiating a claim involves notifying the insurance company about the event that triggered the claim. This typically involves contacting the insurance company through the designated channels, such as a phone call, online portal, or mail. Accurate and prompt reporting is essential to initiate the claims process effectively. The initial contact should provide details about the insured event, including the date, time, location, and nature of the loss.

Documentation Requirements

The required documentation for claims varies depending on the type of claim and the policy’s specifics. Essential documents often include proof of loss, such as medical bills, repair estimates, or police reports. Accurate and complete documentation is crucial for the claim’s evaluation and approval. Failure to provide necessary documentation may delay or even prevent the claim from being processed.

Examples include: photographs of the damaged property, a copy of the policy, and a detailed description of the circumstances leading to the loss.

Claim Evaluation and Resolution

The insurance company evaluates the claim based on the provided documentation and policy terms. This assessment considers factors like the nature of the loss, the policy’s coverage, and any applicable exclusions. The evaluation process may involve an investigation by the insurance company, which might include an on-site inspection. After evaluating the claim, the insurance company may approve or deny it, and if approved, will determine the settlement amount.

The time frame for claim resolution depends on the complexity of the claim and the insurance company’s procedures.

Claim Resolution Timeframes

Claim resolution timeframes are established by the insurance company and often vary based on the type of claim. For example, a simple property damage claim might be resolved within a few weeks, while a complex medical claim could take several months. These timeframes are usually Artikeld in the policy documents. It’s important to understand the anticipated resolution time for your specific situation to avoid unnecessary stress.

Claims Process Flowchart

(A visual representation of the claims process, illustrating steps from initiation to resolution, including stages such as notification, documentation review, evaluation, and settlement.)

(A visual representation of the claims process, illustrating steps from initiation to resolution, including stages such as notification, documentation review, evaluation, and settlement.)

Claim Dispute Resolution

In cases where the policyholder disagrees with the claim’s outcome, a dispute resolution process is available. This typically involves contacting the insurance company’s claims department to explain the reasons for the dispute. Documentation supporting the policyholder’s position may be required. In some cases, mediation or arbitration may be necessary to resolve the dispute. The policy usually details the specific dispute resolution procedures.

Risk Assessment: D Is The Policyowner And Insured For A 50000

A thorough risk assessment is crucial for understanding the potential challenges associated with a policy. This evaluation identifies vulnerabilities and potential losses, allowing for proactive mitigation strategies to be implemented. Assessing the likelihood and impact of these risks is vital for informed decision-making and policy management.Evaluating potential risks is not merely an academic exercise; it’s a practical step towards safeguarding the policyholder’s interests.

A well-defined risk assessment anticipates potential problems, enabling the policyholder to prepare for and manage adverse events.

Potential Risks Associated with the Policy

This section details the potential risks inherent in a $50,000 policy, acknowledging that the specific risks and their likelihood will vary depending on individual circumstances. It’s important to remember that not all risks are equally probable or impactful.

- Policyholder’s Health: A decline in the policyholder’s health could lead to increased healthcare costs, potentially exceeding the policy’s coverage. The likelihood of this risk varies greatly depending on the policyholder’s pre-existing conditions and age. The impact on the policyholder could be significant, impacting their financial stability. Mitigation strategies include regular health check-ups, adopting a healthy lifestyle, and exploring supplemental insurance for high-cost events.

- Policyholder’s Financial Circumstances: Unexpected financial hardships, such as job loss or significant debts, could impact the policyholder’s ability to maintain the policy or utilize its benefits. The likelihood of this risk is relatively high, especially in volatile economic environments. The impact could range from difficulty paying premiums to loss of coverage entirely. Mitigation strategies include budgeting, creating an emergency fund, and exploring affordable policy options.

- Changes in the Insurance Market: Changes in the insurance market, such as rising premiums or reduced coverage, can impact the policy’s value. The likelihood of such changes depends on factors like inflation and industry trends. The impact can be felt in terms of decreased policy value or increased premium costs. Mitigation strategies involve regular policy reviews, comparing different insurance options, and staying informed about market trends.

- Claims Processing Delays: Delays in claims processing could negatively affect the policyholder’s ability to access needed funds. The likelihood of delays depends on the insurance company’s efficiency and case complexity. The impact on the policyholder could be financial stress or emotional distress, especially in urgent situations. Mitigation strategies include careful claim documentation, clear communication with the insurance company, and understanding the policy’s claims process.

Given that D is the policyowner and insured for a 50,000 policy, the optimal choice of nailing tool for various construction tasks, like securing smaller components, becomes relevant. Consideration of the comparative strengths and weaknesses of different nail guns, such as the 18 gauge nailer vs 16 gauge ( 18 gauge nailer vs 16 gauge ), is crucial for cost-effective and efficient project completion.

Ultimately, the appropriate selection hinges on the specific demands of the construction project and the associated budgetary constraints within the 50,000 policy limit.

Likelihood and Impact Assessment

Assessing the likelihood and impact of each risk is critical for prioritizing mitigation strategies. This is not a precise science, but rather an educated estimation based on historical data, industry trends, and individual circumstances.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Policyholder’s Health Deterioration | Medium to High | Significant Financial Strain | Regular health check-ups, healthy lifestyle, supplemental insurance |

| Policyholder’s Financial Hardship | High | Loss of Coverage or Benefit Access | Budgeting, emergency fund, affordable policy options |

| Changes in the Insurance Market | Medium | Decreased Policy Value or Increased Premiums | Regular policy reviews, market research, alternative policy options |

| Claims Processing Delays | Low to Medium | Financial and Emotional Distress | Clear claim documentation, prompt communication, understanding claims process |

Policyholder Responsibilities

Policyholders play a crucial role in maintaining the validity and effectiveness of their insurance policies. Understanding and adhering to policy terms and conditions is essential for ensuring the policy functions as intended and for the policyholder’s protection. A thorough understanding of responsibilities ensures claims are processed smoothly and the policyholder avoids any penalties or voiding of coverage.Adherence to policy terms and conditions is paramount to ensure the policy remains in force and protects the policyholder.

Failure to comply with Artikeld responsibilities can result in denial of claims or voiding of coverage, leaving the policyholder without the protection they expected. This section Artikels the key duties and obligations of the policyholder.

Policy Compliance and its Importance

Policy compliance is critical for maintaining valid coverage. This involves understanding and adhering to the specific terms and conditions Artikeld in the policy document. Non-compliance can lead to significant consequences, including claim denial, policy cancellation, or limitations on coverage. Policyholders are responsible for knowing and abiding by all the rules and regulations set forth in their specific policy.

Examples of Policy Violations

Several actions can violate policy terms and potentially result in coverage limitations or denial. Examples include failing to report accidents or incidents promptly as required by the policy, providing false information in the application or during the claims process, or using the policy for purposes beyond its intended scope. Additionally, failure to maintain required documentation, like proof of payment, or modifications of the insured property without notification to the insurance company, could also be considered a violation.

Policyholder Responsibilities

Understanding and adhering to the following responsibilities is critical for maintaining policy validity and ensuring coverage.

- Accurate Information Provision: Providing accurate and complete information during the application process and any subsequent updates is essential. Misrepresenting facts or omitting critical details can lead to claim denial or policy cancellation. Policyholders must ensure all data is correct and up-to-date.

- Prompt Reporting of Accidents/Incidents: Reporting accidents or incidents promptly as specified in the policy is vital. Delays in reporting can impact the claims process and potentially limit coverage. Policies often specify deadlines and methods for reporting.

- Maintaining Property in Safe Condition: Policyholders are often responsible for maintaining the insured property in a safe condition to prevent incidents. This may include following building codes, performing routine maintenance, or taking other reasonable precautions.

- Payment of Premiums: Timely payment of premiums is crucial for maintaining active coverage. Failure to pay premiums on time can lead to policy lapse and loss of coverage.

- Adherence to Policy Conditions: Policyholders must understand and comply with all conditions Artikeld in the policy document. These conditions may relate to specific activities, use of the property, or other factors.

- Maintaining Records: Policyholders must maintain and provide necessary records, such as receipts, documentation, and other supporting evidence when requested by the insurance company.

Illustrative Examples

This section provides real-world scenarios illustrating the application of a $50,000 insurance policy. Understanding how this type of policy functions in various situations can help potential policyholders make informed decisions. We’ll explore common uses of the coverage amount and present a case study for a clear demonstration.

Coverage Application in Home Repairs

A homeowner’s policy with a $50,000 coverage amount can be instrumental in addressing significant home repairs. Consider a scenario where a pipe bursts, causing extensive water damage to multiple rooms. The policy could cover the cost of repairs, including replacing damaged flooring, drywall, and appliances, up to the policy limit. In cases where repairs exceed the coverage amount, the policyholder would be responsible for the remaining expenses.

Furthermore, the policy could also cover the cost of temporary living arrangements if the home becomes uninhabitable due to the damage.

Coverage for Vehicle Accidents

A $50,000 policy for a vehicle can cover significant repair costs in an accident. For example, a collision involving substantial damage to the vehicle’s frame and other components, such as the engine or transmission, could exceed the coverage amount, and the policyholder would be responsible for the difference. The policy might also cover medical expenses for those involved in the accident, up to a predetermined limit.

However, this coverage is contingent upon the policy’s specific terms and conditions.

Coverage for Medical Emergencies

The policy can also cover medical emergencies. A sudden and unexpected illness or injury requiring hospitalization and extensive medical treatments can easily surpass the $50,000 coverage limit. In such cases, the policyholder might need to consider supplemental insurance to ensure full coverage for all medical expenses. Factors like pre-existing conditions and the nature of the emergency can affect the policy’s applicability and the extent of coverage.

Case Study: Home Fire

A family with a $50,000 homeowner’s insurance policy experienced a house fire that destroyed most of their belongings. The policy covered the cost of rebuilding the damaged structure, including repairs to the roof, walls, and foundation. It also covered the replacement of household items, such as furniture, electronics, and clothing. However, the policy did not cover the replacement of sentimental items, like family heirlooms, as these are not typically included in standard policies.

This demonstrates how the coverage amount is applied in a catastrophic event.

Final Wrap-Up

In conclusion, the policy, designed for d as both policyowner and insured, offers a substantial 50000 in coverage, impacting various aspects of their financial well-being. Understanding the policy’s details, financial implications, legal considerations, and claims procedures empowers d to make informed decisions. Navigating the potential risks and responsibilities Artikeld in this guide equips d to leverage this policy to its full potential.

Question & Answer Hub

What are the typical premium payments for this policy?

Premium payments vary depending on factors such as coverage amount, risk assessment, and policy type. A detailed breakdown of premium options is available in the policy document and can be discussed with a financial advisor.

What are the potential legal issues associated with being both policyowner and insured?

Potential legal issues can include conflicts of interest, disputes over claim settlements, and misinterpretations of policy terms. The policy document and legal counsel can clarify these potential challenges.

How does this policy differ from other similar policies?

The policy’s unique aspect lies in its tailored approach for d as both policyowner and insured. This specific structure may influence the premiums, coverage amounts, and claim procedures compared to policies designed for separate roles.

What are the steps involved in filing a claim?

The claims process, detailed in the policy document, typically involves reporting the claim, providing necessary documentation, and following the prescribed steps for claim resolution. A claims representative can assist in the process.