Malpractice insurance for occupational therapists is crucial for protecting your livelihood and reputation. This comprehensive guide dives deep into the intricacies of these policies, outlining their essential components, common reasons for needing coverage, and the vital role they play in safeguarding therapists from financial liability.

Understanding the specifics of professional liability versus general liability is key. We’ll explore the types of incidents covered, potential exclusions, and the claims process. Plus, we’ll uncover strategies for risk management and compare various insurance providers to help you find the best fit for your practice.

Overview of Occupational Therapist Malpractice Insurance

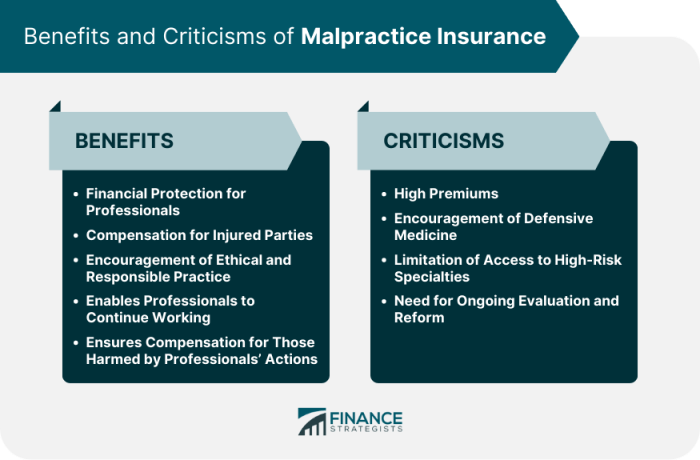

Occupational therapist malpractice insurance is a crucial component of professional practice. It safeguards therapists from financial repercussions stemming from errors or omissions in their professional duties. This coverage is essential for maintaining both financial stability and professional reputation.Occupational therapists frequently encounter situations where their actions or judgments may lead to adverse outcomes for clients. These outcomes could range from minor complications to significant injuries or setbacks in recovery.

Comprehensive malpractice insurance mitigates the financial burden associated with such scenarios.

Key Components and Features of Occupational Therapist Malpractice Insurance

Occupational therapist malpractice insurance policies typically include coverage for claims arising from errors, omissions, or negligent acts in the course of professional practice. These policies typically cover legal defense costs, settlement amounts, and judgments awarded against the therapist. Specific policy features may vary by insurer and policy type.

Common Reasons for Occupational Therapists to Require This Coverage

Occupational therapists may face claims of negligence in various aspects of their practice, including treatment plans, evaluations, or recommendations. Inadequate documentation, failure to meet professional standards, or misdiagnosis can also lead to malpractice claims. The potential for claims related to patient outcomes, particularly in cases of injury or worsening condition, necessitates robust coverage.

Importance of Insurance in Protecting Therapists from Financial Liability

Without malpractice insurance, occupational therapists could face substantial financial liabilities in the event of a claim. Legal fees, settlement costs, and judgments can quickly deplete personal assets. Malpractice insurance protects therapists from these financial risks, allowing them to focus on providing quality care without the constant fear of catastrophic financial consequences.

Professional Liability vs. General Liability Insurance

Professional liability insurance, often referred to as malpractice insurance, specifically addresses errors and omissions in the performance of professional duties. General liability insurance, on the other hand, covers broader risks, such as injuries to third parties on the premises. Occupational therapists require professional liability insurance to address the unique risks inherent in their profession.

Comparison of Coverage Options for Occupational Therapist Malpractice Insurance

| Coverage Type | Description | Example Scenarios Covered | Potential Exclusions |

|---|---|---|---|

| Claims-Made Coverage | Coverage applies only to claims made during the policy period, regardless of when the alleged act occurred. | A claim filed in 2024 for an alleged error in 2022, if the policy is active in 2024. | Claims made prior to the policy period are not covered. |

| Occurrence Coverage | Coverage applies to any claims arising from an incident that occurred during the policy period, even if the claim is filed later. | A claim filed in 2026 for an alleged error in 2023, if the policy was active in 2023. | Claims that occur outside the policy period are not covered. |

| Aggregate Limits | A maximum total amount of coverage available for all claims during a policy period. | A maximum of $1,000,000 in total claims during the policy year. | May not cover claims exceeding the aggregate limit. |

| Per Claim Limits | A maximum amount of coverage available for a single claim. | $250,000 per claim for any one incident. | Claims exceeding the per-claim limit may not be fully covered. |

Coverage Details and Policy Provisions

Occupational therapist malpractice insurance policies are designed to protect practitioners from financial liability arising from claims of negligence in the course of their professional duties. Understanding the specific coverage, exclusions, and limitations within these policies is crucial for therapists to ensure adequate protection. These policies, while providing a safety net, do not guarantee immunity from all potential legal actions.

Types of Incidents Covered

Occupational therapy malpractice insurance typically covers incidents where a therapist’s actions or inactions, within the scope of their professional duties, are alleged to have caused harm or damages to a patient. This includes, but is not limited to, errors in assessment, treatment planning, intervention techniques, or documentation. A thorough review of the policy language is essential to determine the specific types of incidents covered.

Examples of Coverage Triggering Situations

Coverage would be triggered in situations where a therapist is accused of:

- Failing to properly assess a patient’s needs, leading to inappropriate treatment.

- Implementing an unsafe treatment plan that results in injury or exacerbation of existing conditions.

- Providing inadequate or delayed interventions that negatively impact a patient’s recovery.

- Failing to maintain appropriate documentation of treatment sessions, leading to disputes or misunderstandings.

- Failing to obtain informed consent for treatment or interventions.

Common Exclusions and Limitations

Malpractice insurance policies often contain exclusions and limitations to define the scope of coverage. Common exclusions include:

- Pre-existing conditions: Coverage may not extend to harm caused by a patient’s pre-existing conditions that were not directly aggravated by the therapist’s actions.

- Acts of fraud or intentional misconduct: Policies typically exclude intentional acts of wrongdoing, such as fraud, deceit, or malicious intent.

- Claims arising from services outside the scope of practice: If a therapist provides services outside their licensed area of practice, the policy may not cover related claims.

- Claims resulting from the use of prescription drugs or medical devices: Coverage may be limited or excluded in cases where the treatment plan involves the use of prescription medications or medical devices.

- Claims based on the patient’s failure to comply with the treatment plan: If a patient fails to adhere to a prescribed treatment plan and this failure leads to negative outcomes, coverage may be excluded.

Definition of Negligence

The policy’s definition of “negligence” is crucial for determining coverage. This definition usually Artikels the standard of care expected of an occupational therapist in similar circumstances and whether the therapist’s actions fell below that standard. A therapist’s failure to meet the accepted professional standards can be considered negligence.

Policy Limits and Potential Claims

Policy limits represent the maximum amount the insurer will pay out in a claim. These limits vary significantly based on the policy and the therapist’s experience. A therapist should carefully consider their potential exposure to claims and select a policy with adequate limits to protect against significant financial loss. Policy limits should align with the therapist’s risk profile.

For example, a therapist with a higher volume of patients or those working in specialized areas may require a higher policy limit. It is important to remember that policy limits are not an estimate of a claim’s outcome, as legal processes can significantly influence the final settlement amount.

Factors Influencing Insurance Costs

Several factors influence the cost of occupational therapist malpractice insurance. These factors include:

- Years of experience: More experienced therapists may have a lower risk profile, potentially leading to lower premiums.

- Type of practice: Therapists working in high-risk areas, such as those treating individuals with complex medical conditions or those working with vulnerable populations, may face higher premiums.

- Location: The geographic location of the therapist’s practice may influence the cost of insurance, based on local court precedents or claims frequency.

- Policy coverage and limits: A higher policy limit typically comes with a higher premium.

- Claims history: Prior claims or lawsuits can significantly increase insurance premiums.

Claims Process and Considerations: Malpractice Insurance For Occupational Therapist

Occupational therapist malpractice insurance claims are complex processes requiring careful navigation by both the insured therapist and the insurance company. Understanding the typical steps, roles, and potential complications is crucial for a smooth and efficient resolution. This section details the claims process, outlining responsibilities and considerations to minimize potential disputes.

Typical Steps in Filing a Claim

The process typically begins with a notification of a potential claim. This notification may come from a patient, a legal representative, or another party involved in the case. The next crucial step involves a thorough investigation of the reported incident by the insurance company. This investigation will often include reviewing documentation, interviewing parties involved, and potentially consulting with experts.

Following the investigation, the insurance company assesses the claim against the policy terms, determining coverage and the extent of potential liability. Finally, negotiations and settlements are pursued, or litigation may be initiated depending on the specific circumstances and policy provisions.

Role of the Insurance Company in Handling a Claim

The insurance company acts as the intermediary between the therapist and the claimant. Their role includes investigating the incident, evaluating the potential liability, and determining coverage under the policy. This includes assessing the validity of the claim, the scope of the therapist’s actions, and any contributing factors from other parties. Furthermore, the insurance company will likely defend the therapist in court if the claim proceeds to litigation.

They also work to settle the claim amicably whenever possible, to minimize costs and expedite the process.

Rights and Responsibilities of the Occupational Therapist

The occupational therapist has specific rights and responsibilities during the claim process. They have the right to be informed of the claim’s progress and to be involved in the claim’s resolution process. Responsibilities include promptly reporting any potential claims to the insurance company, providing all requested documentation, and cooperating fully with the investigation. It is crucial to maintain accurate and complete records of all relevant interactions with the patient.

This includes adhering to professional ethics and maintaining communication with the insurance company.

Comparison of Claim Handling Procedures

Different policy types may have varying claim handling procedures. Policies with higher limits, for instance, might have more resources dedicated to handling complex claims. Policies focusing on specific practice areas, like pediatrics, might involve specialized review procedures tailored to the unique considerations of that field. Understanding the specific provisions of the policy is critical for navigating the process effectively.

Potential Complications in the Claims Process

Potential complications can arise from various factors. The complexity of the case, the involvement of multiple parties, and the availability of crucial evidence can all create challenges. Furthermore, disagreements about the scope of the therapist’s duties or the extent of harm caused can prolong the process. In some cases, the claim may involve legal representation, which will significantly increase the complexity and timeline.

Occupational therapists require malpractice insurance to protect against claims of negligence. This coverage is crucial for safeguarding against potential liabilities arising from treatment errors. While focusing on the intricacies of occupational therapy practice, it’s important to note that the recent release of the “pizza tower lap 3 midi” pizza tower lap 3 midi game, may have inspired new creative therapy approaches, but this doesn’t alter the need for professional liability insurance to mitigate risks associated with clinical practice.

Delayed or incomplete documentation from the therapist can also hinder the claim resolution.

Step-by-Step Process for Handling a Malpractice Claim

Claims Process

- Notification of Claim: Upon receiving notification of a potential claim, immediately contact your insurance provider and follow their prescribed procedures for reporting the claim.

- Documentation Collection: Gather all relevant documents, including patient records, treatment plans, and communication logs. Ensure all documentation is complete and accurate.

- Cooperation with the Insurance Company: Fully cooperate with the insurance company’s investigation, providing all requested information and attending any necessary interviews.

- Legal Advice (if applicable): Seek legal counsel if the claim progresses to litigation, especially for complex cases involving potential legal implications.

- Review of Policy Provisions: Familiarize yourself with the specific policy provisions and conditions related to the claim.

- Settlement Negotiation (if applicable): Actively participate in settlement negotiations, guided by your legal counsel if necessary.

Risk Management for Occupational Therapists

Occupational therapists face a unique set of risks that, if not properly managed, can lead to malpractice claims. Understanding these potential pitfalls and implementing proactive risk management strategies is crucial for maintaining a safe and ethical practice environment. A comprehensive approach to risk management encompasses various facets, from meticulous documentation to effective communication with patients and their families.Effective risk management in occupational therapy is not simply about avoiding mistakes; it’s about proactively identifying potential problems and implementing preventative measures.

This proactive approach not only safeguards therapists from potential liability but also fosters a positive therapeutic environment that prioritizes patient safety and well-being.

Common Risks Leading to Malpractice Claims

Occupational therapists may face malpractice claims arising from various circumstances. These risks often stem from deviations from accepted standards of care, inadequate documentation, and communication breakdowns. Common examples include errors in treatment planning, failure to recognize or address patient deterioration, inadequate supervision of assistive personnel, and inappropriate delegation of tasks. Furthermore, issues surrounding informed consent and patient autonomy can also lead to legal challenges.

Preventative Measures to Mitigate Risks

Proactive measures can significantly reduce the likelihood of malpractice claims. These measures should be integrated into the daily practice routine. A robust system of documentation, clear communication protocols, and adherence to evidence-based practice guidelines are crucial. Regular reviews of treatment plans, patient progress, and potential complications are essential. Moreover, maintaining up-to-date knowledge of relevant laws and regulations is paramount.

Strategies for Maintaining Accurate and Complete Documentation

Thorough and accurate documentation is a cornerstone of risk management in occupational therapy. Documentation should reflect the patient’s needs, the therapist’s interventions, and the patient’s response. It must be detailed, objective, and chronologically organized. Documentation should be easily retrievable, clear, and understandable, while also providing a comprehensive record of the entire therapeutic process. Examples include meticulously recording treatment sessions, assessments, and any changes in patient condition.

The use of standardized forms and templates can enhance consistency and accuracy. Crucially, all entries should be signed and dated.

Importance of Informed Consent and Patient Communication

Informed consent is a fundamental ethical principle in occupational therapy. It necessitates ensuring patients understand the proposed treatment, potential risks and benefits, and alternatives. Effective communication is vital in establishing trust and fostering a collaborative therapeutic relationship. Open dialogue about treatment goals, expectations, and potential challenges is critical. Therapists should document the informed consent process meticulously, ensuring all parties understand their roles and responsibilities.

The documentation should reflect the patient’s comprehension and agreement to the treatment plan.

Legal Considerations in Occupational Therapy Practice

Occupational therapists must be aware of relevant legal considerations in their practice. These include state and federal laws governing practice, professional licensing requirements, and standards of care established by professional organizations. Familiarity with relevant legal precedents and potential liabilities is crucial. Occupational therapists should stay abreast of any changes in legislation that may affect their practice.

Best Practices for Proper Risk Management

Implementing best practices can significantly reduce the likelihood of malpractice claims. These practices include adhering to evidence-based practice guidelines, maintaining current knowledge and skills, and engaging in continuing education. Furthermore, seeking consultation with colleagues or supervisors on complex cases can prevent errors. Active participation in professional organizations and adherence to ethical codes of conduct also enhance risk management.

Utilizing risk assessment tools can identify potential vulnerabilities and enable proactive mitigation strategies. Maintaining a professional liability insurance policy is essential.

Comparing Different Insurance Providers

Selecting the appropriate malpractice insurance provider is crucial for occupational therapists. This process necessitates a thorough understanding of various offerings and a careful evaluation of individual needs. Insurance providers tailor their coverage packages to address specific professional risks and responsibilities. Understanding these nuances is vital to making an informed decision.

Factors to Consider When Selecting a Provider

Several key factors influence the selection of an insurance provider. These include the scope of coverage, the provider’s financial stability, and the level of customer support. Understanding the nuances of these elements is critical to selecting an insurance provider that best meets individual needs.

- Coverage Scope: The extent of coverage offered by different insurance providers varies significantly. Some providers offer broader coverage for a wider range of potential claims, while others may specialize in particular areas or situations. Comprehensive coverage that addresses the complexities of occupational therapy practice is essential.

- Financial Stability: The financial stability of an insurance provider is a critical consideration. A financially sound provider is more likely to meet its obligations in the event of a claim. Researching the provider’s financial history and ratings is vital.

- Customer Support: The quality of customer support offered by an insurance provider is essential. Access to knowledgeable and responsive support staff is crucial, particularly during times of need or claim resolution. Look for providers with a demonstrated commitment to client service and clear communication channels.

- Policy Provisions: Carefully review the policy provisions to ensure that the coverage aligns with your specific needs and practice settings. Look for provisions that address potential liabilities, such as those related to treatment errors, patient injuries, or claims of negligence. Specific endorsements for particular types of occupational therapy practice (e.g., pediatric, geriatric, or industrial) should also be considered.

Policy Reviews and Updates

Regular reviews of insurance policies are essential to ensure continued alignment with evolving professional standards and practice needs. Policy updates may be required to reflect changes in legal interpretations, industry best practices, or technological advancements.

Policies should be reviewed at least annually to reflect changes in professional standards and legal interpretations. The review should address potential vulnerabilities, emerging risks, and any changes in the occupational therapy practice environment.

Comparing Policy Pricing and Coverage, Malpractice insurance for occupational therapist

Comparing policy pricing and coverage across different providers involves a structured approach. Thorough research is essential to find the best fit for your needs.

- Gather Quotes: Request quotes from multiple insurance providers. Be specific about your needs and the scope of your practice.

- Analyze Coverage Details: Carefully compare the coverage details, including the limits of liability, exclusions, and endorsements. Understand how the policy addresses different scenarios and potential claims.

- Evaluate Policy Costs: Compare the premiums charged by different providers. Consider not only the initial premium but also any additional costs associated with the policy, such as deductibles, co-pays, and administrative fees. A comprehensive cost analysis is critical for budgeting.

Insurer Comparison Table

This table provides a comparative overview of several insurance providers for occupational therapists. Note that specific coverage details and costs can vary, and it is crucial to consult with the individual providers for precise information.

| Insurance Provider | Coverage Highlights | Policy Costs | Customer Reviews |

|---|---|---|---|

| Provider A | Broad coverage, extensive endorsements, strong customer support | Competitive pricing, tiered options | Generally positive, with reported efficiency in claim processing |

| Provider B | Focus on specific practice areas (e.g., pediatric OT), detailed policy provisions | Higher premiums for specialized coverage | Positive feedback on specialized expertise, mixed reviews on general customer service |

| Provider C | Comprehensive coverage, robust claims support, strong financial stability | Higher premiums than some competitors | High ratings for claim resolution and service |

| Provider D | Emphasis on risk management tools, online resources, preventive strategies | Lower premiums, potentially narrower coverage | Positive reviews on educational resources and risk management support |

Current Trends and Future Outlook

Occupational therapist malpractice insurance is constantly evolving to address the changing landscape of healthcare and the unique challenges faced by practitioners. Understanding current trends and anticipating future developments is crucial for therapists to make informed decisions about their professional liability protection. This section explores emerging issues and potential impacts on insurance policies.

Current Trends in Occupational Therapist Malpractice Insurance

Several key trends are shaping the occupational therapist malpractice insurance market. Increased litigation, evolving standards of care, and technological advancements are significantly impacting coverage options and pricing. The rise of telehealth and remote practice models, for instance, has introduced new complexities that insurers are actively addressing through policy revisions.

Emerging Challenges and Opportunities

The field of occupational therapy presents both challenges and opportunities for insurers. The growing emphasis on patient outcomes and accountability creates a need for comprehensive coverage options, including policies tailored to specific practice settings and patient populations. The rise of technology presents both opportunities for enhanced risk management and new potential liabilities. Telehealth, for instance, presents unique challenges concerning liability, informed consent, and access to appropriate resources.

Conversely, technological advancements can improve documentation and communication, reducing potential errors and claims.

Influence of Technology on Risk Management and Insurance

Technology is significantly impacting occupational therapy practice and, consequently, malpractice insurance. Electronic health records (EHRs), telehealth platforms, and other digital tools offer improved documentation and communication. However, these advancements also present potential risks, including data breaches, system malfunctions, and the need for cybersecurity protocols. Insurers are increasingly incorporating technological factors into risk assessment and policy design. For example, policies may require therapists to maintain specific cybersecurity measures or incorporate telehealth-specific coverage to mitigate these risks.

Occupational therapists require professional liability insurance to protect against claims of negligence. Understanding coverage options is crucial, and while not directly related, exploring insurers offering comprehensive European car insurance, like those detailed in which insurers offer 180 car insurance european cover , can highlight the complexities of tailored insurance solutions. Ultimately, selecting the right malpractice insurance for occupational therapists demands careful consideration of potential risks and the specific needs of the practice.

Recent Changes and Updates in the Insurance Market

The occupational therapist malpractice insurance market has seen several recent changes. Insurers are now offering more specialized coverage options, tailored to the unique needs of specific practice settings or populations. For example, insurers might offer separate pricing structures for therapists working in home health, schools, or hospitals. There’s also a growing emphasis on proactive risk management, with some insurers now offering programs that support therapists in developing and implementing strategies to prevent potential claims.

These programs might involve workshops, online resources, or consultation services.

Predicting Future Developments

Future developments in occupational therapist malpractice insurance will likely focus on addressing emerging technologies, adapting to evolving standards of care, and providing comprehensive coverage for new practice models. The increasing prevalence of telehealth and the rise of artificial intelligence (AI) in healthcare will likely necessitate adjustments to policies. Insurance companies are likely to introduce new provisions addressing the specific liabilities associated with these advancements.

For example, policies may need to address the use of AI-assisted diagnostic tools or the liability of using AI-generated treatment recommendations. As healthcare delivery continues to evolve, occupational therapist malpractice insurance will need to adapt accordingly to ensure comprehensive protection for practitioners.

Conclusive Thoughts

In conclusion, safeguarding your occupational therapy practice requires a keen understanding of malpractice insurance. This guide has provided a thorough overview of the policies, processes, and considerations involved. By understanding the intricacies of coverage, risk management, and provider comparisons, you’re empowered to make informed decisions that protect your practice and professional future.

Questions and Answers

What are some common reasons occupational therapists might need malpractice insurance?

Errors in treatment, misdiagnosis, failure to meet professional standards, and inadequate documentation can all lead to malpractice claims. This insurance protects against potential financial repercussions from such situations.

How do I compare policy pricing and coverage options from different insurers?

Look for online comparison tools or directly contact multiple providers to obtain detailed quotes. Compare coverage limits, exclusions, and the claims process to make an informed decision.

What is the typical claims process for occupational therapy malpractice insurance?

The process generally involves reporting the claim, gathering documentation, and potentially a review by the insurance company and/or a third party. Thorough documentation and communication are key during this stage.

What are some preventative measures to mitigate malpractice risks in occupational therapy practice?

Maintain accurate records, adhere to ethical guidelines, and communicate effectively with patients and their families. Regular continuing education and staying updated on best practices can also minimize risks.