Abu Dhabi Commercial Bank SWIFT code, essential for international transfers. Finding it’s super easy, but knowing how to use it safely is key. This guide breaks down everything you need to know, from what a SWIFT code is to how to protect yourself online. Let’s get you covered!

This comprehensive guide will walk you through the process of finding the Abu Dhabi Commercial Bank SWIFT code, ensuring you have the right information for smooth and secure international transactions. We’ll cover everything from simple searches to advanced security measures. Get ready to master the art of international money transfers!

Understanding the SWIFT Code

Staying ahead in today’s globalized financial landscape demands a grasp of crucial tools like SWIFT codes. These codes are fundamental for seamless international transactions, ensuring secure and efficient transfers of funds across borders. Understanding their structure and function empowers you to navigate international finance with confidence.SWIFT codes are unique alphanumeric identifiers that pinpoint specific financial institutions. This precise identification system is vital for verifying the recipient’s bank and ensuring funds reach the correct destination.

Think of it as a precise address for international money transfers.

SWIFT Code Definition and Purpose

A SWIFT code, short for Society for Worldwide Interbank Financial Telecommunication code, is a unique 8, 11, or 16-character alphanumeric identifier assigned to a financial institution. Its primary purpose is to facilitate secure and unambiguous identification of the institution in international financial transactions. This system streamlines and verifies transactions, preventing errors and fraudulent activities.

Structure of a SWIFT Code

SWIFT codes are meticulously structured to convey specific information about the institution. Their structure isn’t arbitrary; each segment holds a crucial piece of the puzzle. This systematic design ensures accurate routing of financial messages.

| Component | Description | Example (8 characters) | Example (11 characters) | Example (16 characters) |

|---|---|---|---|---|

| Country Code | Identifies the country where the institution is located. | UAE | UAE | UAE |

| Institution Code | Further specifies the particular institution within the country. | ABUDHA | ABUDHAB | ABUDHABICB |

The table above demonstrates the typical structure, showing how different components contribute to the complete code. Note that the specific structure can vary based on the institution’s size, function, and location.

How SWIFT Codes Identify Financial Institutions

The SWIFT code system uses a hierarchical structure to pinpoint the financial institution. The initial segment (country code) narrows down the location, while the subsequent segments identify the specific bank. This precise identification process ensures the transfer of funds reaches the intended recipient without any ambiguity.

Importance of Accurate SWIFT Codes for Secure Transactions

An accurate SWIFT code is paramount for secure transactions. Inaccurate codes can lead to misrouting, delayed payments, or even fraudulent activities. This underscores the importance of meticulously verifying and confirming the SWIFT code for any international transfer. Double-checking the code minimizes potential errors and safeguards against financial loss.

Using SWIFT Codes in Practice

Knowing the SWIFT code is essential for initiating international wire transfers. It ensures the funds are transferred to the correct bank account, avoiding potential errors. A correct code ensures that the transfer arrives promptly and securely.

Finding the Abu Dhabi Commercial Bank SWIFT Code

Staying updated on financial matters is key in today’s fast-paced world. Knowing the SWIFT code for Abu Dhabi Commercial Bank empowers you to execute transactions smoothly and efficiently. This guide provides a practical approach to finding this crucial piece of information.Knowing the SWIFT code is vital for international wire transfers. It ensures your funds reach the correct destination, avoiding delays and potential errors.

Navigating the complexities of international transactions? Knowing the Abu Dhabi Commercial Bank SWIFT code is crucial. But for seafarers seeking offshore banking solutions, the Standard Bank Offshore Seafarers Account standard bank offshore seafarers account might be a superior option. Ultimately, understanding the right SWIFT code for your needs remains paramount for seamless global financial operations.

The method you choose should prioritize accuracy and speed to optimize your financial processes.

Efficient SWIFT Code Lookup Methods

Locating the Abu Dhabi Commercial Bank SWIFT code is straightforward using various reliable resources. Different methods cater to various preferences and circumstances. Consistency in your approach to finding this crucial information will contribute to the smooth execution of your financial transactions.

Bank Website Lookup

The most direct and often most accurate method involves consulting the official Abu Dhabi Commercial Bank website. Look for a dedicated section on international banking or wire transfer procedures. The SWIFT code should be readily available within these sections.

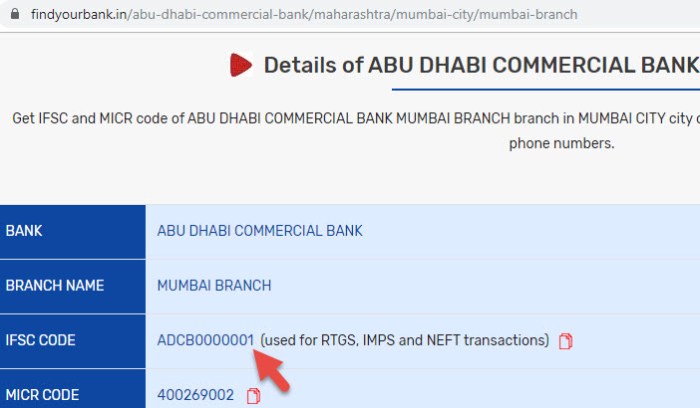

Example Website Search Process

To find the code, navigate to the Abu Dhabi Commercial Bank website. Search for “international banking” or “wire transfers” in the website’s search bar. Once you find the relevant page, look for a section detailing international transactions. The SWIFT code should be clearly displayed within that section. If the website is well-organized, this process is quick and easy.

You can also look for a dedicated section for SWIFT codes, if available.

Online Search Engines and Financial Data Providers

Beyond the bank’s website, reputable online search engines and financial data providers can furnish the SWIFT code. Searching for “Abu Dhabi Commercial Bank SWIFT code” on Google, for example, can lead you to verified sources. Be cautious about the source and ensure the site is trustworthy to avoid errors. Always cross-reference information with the official bank’s website for confirmation.

List of Potential Websites

- Abu Dhabi Commercial Bank official website

- Google Finance

- Bloomberg.com (if subscription access is available)

- Reuters.com (if subscription access is available)

- World-renowned financial data providers (e.g., Refinitiv, FactSet)

These resources offer various levels of detail and ease of use. By carefully reviewing the source and confirming with the official bank’s website, you can be sure of the accuracy of the information. It is recommended to check for updated information.

Verification and Validation

Staying on top of your financial game requires meticulous attention to detail. This includes double-checking the accuracy of crucial information like SWIFT codes. A single typo can lead to significant delays and potential financial losses. Savvy financial management demands a thorough verification process.Thorough verification and validation of your SWIFT code ensures the smooth transfer of funds and minimizes the risk of errors.

Understanding the significance of this step is critical for anyone handling international transactions. This meticulous process safeguards your financial transactions and avoids costly mistakes.

Significance of Verifying the SWIFT Code

Accurate SWIFT codes are paramount for successful international money transfers. An incorrect code can lead to funds being misdirected, lost, or delayed, causing frustration and potential financial repercussions. Verifying the code ensures the funds reach the intended recipient. It’s like ensuring your letter arrives at the right address—a fundamental step for smooth communication.

Methods for Validating SWIFT Code Accuracy

Several methods can validate the accuracy of your SWIFT code. The most reliable method is cross-referencing with official sources. Using unofficial websites or outdated information can introduce errors, so it’s crucial to utilize trusted resources.

Cross-Referencing with Official Sources

Cross-referencing is the cornerstone of SWIFT code validation. The official website of the bank issuing the SWIFT code is the most reliable source. Directly contacting the bank’s customer service department is another way to confirm the code. These official channels provide the most accurate and up-to-date information. Avoid using third-party websites or unverified sources, as these can contain outdated or inaccurate data.

Potential Errors from Incorrect SWIFT Codes

Employing an incorrect SWIFT code can lead to a multitude of errors. The most obvious consequence is that the funds won’t reach the intended recipient. This can cause significant delays, potentially impacting business operations or personal transactions. Moreover, it can lead to financial losses and complications in resolving the issue. The financial implications of a single error can be substantial.

Reliability of Various Sources

| Source | Reliability | Explanation |

|---|---|---|

| Bank’s Official Website | High | Direct access to the most current and accurate information. |

| Bank’s Customer Service | High | Direct confirmation from the institution issuing the code. |

| Unofficial Online Directories | Low | Potentially outdated or inaccurate information, leading to errors. |

| Social Media Posts | Very Low | Information can be unreliable and unverifiable. |

Utilizing reliable sources ensures accurate information. Unofficial or outdated resources can introduce errors and complications.

Practical Applications

Navigating the global financial landscape demands precision, especially when sending and receiving international funds. Knowing how to use your bank’s SWIFT code effectively is key to smooth transactions. This section will detail the crucial role of the SWIFT code in today’s interconnected world, from online banking to critical transfer situations.

Role in International Money Transfers

The SWIFT code is the lifeblood of international transactions. It’s a unique alphanumeric identifier that uniquely identifies your bank, ensuring funds reach the correct recipient. This prevents costly errors and delays, a crucial aspect of global commerce and personal finance. Think of it as the digital address for your financial institution, facilitating smooth transfers across borders.

Unlocking the secrets of the Abu Dhabi Commercial Bank SWIFT code is crucial for seamless international transactions. Imagine the culinary possibilities, though, with a delectable bone marrow recipe air fryer – bone marrow recipe air fryer. Knowing the precise SWIFT code ensures your financial dealings are as straightforward as a perfectly executed culinary masterpiece, just like you’d find with the precision of the Abu Dhabi Commercial Bank SWIFT code.

Use in Online Banking Platforms

Modern online banking platforms seamlessly integrate the SWIFT code. Many platforms automatically populate the required fields during international transfer requests, streamlining the process. This integration saves time and reduces the chance of human error, making international transactions more efficient. Users can easily find and input the SWIFT code for the recipient bank, often found in the account details section.

Situations Requiring an Accurate SWIFT Code

An accurate SWIFT code is essential in numerous scenarios. International payments, whether for business deals, educational fees, or personal remittances, all require this code for verification. Errors in the SWIFT code can lead to delays, lost funds, or even fraud attempts, making its accuracy paramount. The SWIFT code ensures your money reaches its intended destination, minimizing the risks associated with international transactions.

Common Scenarios Requiring the Abu Dhabi Commercial Bank SWIFT Code

The Abu Dhabi Commercial Bank SWIFT code is crucial in several everyday situations. For example, sending money to a family member abroad, paying for an international service, or making business transactions internationally all necessitate the correct SWIFT code. It’s a vital component of any cross-border financial interaction, safeguarding transactions.

Step-by-Step Guide to Including the Code in a Bank Transfer

Including the SWIFT code in a bank transfer is straightforward, following these steps:

- Log in to your Abu Dhabi Commercial Bank online banking platform.

- Locate the “International Transfer” or similar option.

- Input the recipient’s bank details, including the name, account number, and the critical SWIFT code.

- Double-check all information for accuracy, ensuring no typos.

- Initiate the transfer once all details are confirmed.

Following these simple steps ensures your money reaches the correct recipient without delay or error, essential for smooth international transactions.

Security Considerations: Abu Dhabi Commercial Bank Swift Code

Keeping your financial transactions secure is crucial in today’s digital world. Knowing how to handle SWIFT codes responsibly is vital to avoid potential pitfalls. Protecting this sensitive information is paramount for preventing unauthorized access and misuse.

Risks Associated with Sharing SWIFT Codes

Sharing your bank’s SWIFT code carelessly can expose you to various risks. Unauthorized access to this code could lead to fraudulent transactions, potentially costing you significant financial losses. Phishing scams, often disguised as legitimate requests, are a common threat, targeting individuals and businesses alike. These scams attempt to trick users into revealing sensitive information, including SWIFT codes, by mimicking trusted organizations or individuals.

Furthermore, cyberattacks targeting financial institutions can indirectly compromise the security of SWIFT codes used by their clients.

Protecting SWIFT Code Confidentiality

Protecting the confidentiality of your SWIFT code is essential. Never share it in unsecure environments like public forums or unencrypted emails. Use strong passwords and enable two-factor authentication wherever possible. Regularly review your online banking security settings to ensure they align with the latest security standards. Consider implementing robust access controls to limit access to your SWIFT code to only authorized personnel.

Security Measures to Prevent Misuse

Implementing robust security measures is crucial to prevent unauthorized use of your SWIFT code. Regularly monitor your account statements for any unusual transactions. Immediately report any suspicious activity to your bank. Utilize encryption protocols when transmitting sensitive information, including SWIFT codes, over the internet. Employ firewalls and intrusion detection systems to protect your network from potential threats.

Importance of Secure Online Environments

Secure online environments are paramount when handling SWIFT codes. Always use a trusted and reputable online banking platform. Look for indicators of security, such as HTTPS in the website address, and verify the platform’s security certifications. Avoid using public Wi-Fi networks when accessing sensitive financial information, as these networks are often vulnerable to hacking attempts. Be wary of suspicious links or emails, as these can lead to phishing attacks.

Security Best Practices for Handling SWIFT Codes

Following best practices significantly enhances the security of your SWIFT code.

- Never share your SWIFT code via email, text message, or instant messaging unless you’ve verified the recipient’s authenticity.

- Keep your banking software and operating systems updated to the latest versions to benefit from the latest security patches.

- Do not reuse passwords for different accounts, as this can expose your SWIFT code if one account is compromised.

- Be cautious about clicking on links or attachments from unknown senders.

- Educate yourself and your staff about common phishing tactics to recognize and avoid them.

- Implement a strong password policy and regularly change your passwords to maintain a high level of security.

Alternative Methods and Considerations

Navigating the global financial landscape demands more than just SWIFT codes. Modern international transactions are increasingly multifaceted, requiring a nuanced understanding of alternative methods and identifiers. This section explores these evolving approaches, highlighting the limitations of relying solely on SWIFT codes in today’s dynamic environment.The global financial ecosystem is constantly evolving. New technologies and regulations reshape how businesses and individuals conduct cross-border transactions.

Understanding these changes is crucial for optimizing efficiency and mitigating risks.

Alternative Methods for International Transactions, Abu dhabi commercial bank swift code

Various alternative methods offer competitive advantages over traditional SWIFT-based transactions. These methods often provide faster processing times, lower costs, and enhanced security features. Exploring these alternatives is essential for staying ahead in the current financial landscape.

- Real-time gross settlement (RTGS) systems: These systems facilitate near-instantaneous transfers of funds, significantly reducing processing times compared to traditional methods. Examples include systems employed by major central banks around the world.

- Payment systems like Faster Payments and Fedwire: These domestic payment systems, prevalent in specific regions, offer efficient, low-cost solutions for domestic and international transfers within their respective jurisdictions. Their usage is often complementary to SWIFT for cross-border operations.

- Cross-border payment platforms: Specialized platforms facilitate international transactions with streamlined procedures and often reduced costs. They leverage technology to handle multiple currencies and compliance standards. Examples are prominent players in the global payment infrastructure.

IBANs and Other Identifiers

International Bank Account Numbers (IBANs) provide an alternative to SWIFT codes, especially for domestic transactions within a specific country. IBANs are standardized account identifiers, enhancing efficiency and reducing errors.

- IBAN usage: IBANs are widely adopted in Europe and other regions. They are crucial for domestic transactions and are increasingly used in international transfers, particularly when the recipient’s bank operates within the same country as the sender’s bank.

- Benefits of IBANs: IBANs offer improved accuracy in identifying the correct recipient account, reducing errors and delays inherent in the manual processing of SWIFT codes. This standardization is particularly useful for transactions within a specific region.

SWIFT Codes vs. IBANs

SWIFT codes and IBANs serve distinct purposes in international transactions. SWIFT codes identify the bank, while IBANs identify the specific account. Understanding their respective roles is vital for successful transactions.

| Feature | SWIFT Code | IBAN |

|---|---|---|

| Purpose | Identifies the bank | Identifies the account |

| Scope | International | Typically domestic, but increasingly used in international transactions |

| Accuracy | Focuses on bank identification, potentially prone to errors in account identification | Focuses on account identification, reducing errors compared to SWIFT codes in domestic transactions |

Limitations of Solely Relying on SWIFT Codes

While SWIFT codes are essential, relying solely on them can be problematic in a complex global landscape. Understanding their limitations is crucial for risk mitigation.

SWIFT codes primarily identify the bank, not the specific account. This lack of account-level identification can increase the risk of errors and delays.

Evolution of International Payment Systems

International payment systems are constantly evolving, impacting the role of SWIFT codes. Technological advancements and regulatory changes are driving these transformations.

The rise of digital currencies and blockchain-based solutions introduces new methods of international transactions. These innovations may eventually impact the usage of SWIFT codes.

Troubleshooting and Error Handling

Navigating the world of international finance often involves intricate processes, and SWIFT codes are no exception. Understanding potential pitfalls and how to resolve them is crucial for smooth transactions. This section provides a practical guide to common SWIFT code errors and effective troubleshooting strategies.Troubleshooting SWIFT code issues can stem from various sources, including human error, system glitches, or discrepancies in data entry.

A proactive approach, combined with a methodical troubleshooting process, can help mitigate these issues and ensure the swift and accurate processing of your transactions.

Common SWIFT Code Errors

Various errors can occur during the use of SWIFT codes. These can range from simple typos to more complex system-level issues. Accurately identifying the source of the error is the first step towards resolution.

- Incorrect SWIFT Code: Mistyping the SWIFT code, or using the wrong code for the recipient bank, is a common source of errors. This leads to failed transactions, delayed payments, or potentially incorrect funds transfer to an unintended recipient. Accurate verification of the SWIFT code is critical before initiating a transaction.

- Bank Name Mismatch: A discrepancy between the bank name used in the transaction and the bank name associated with the SWIFT code can also lead to errors. Ensure that the bank name and SWIFT code match the recipient’s details exactly.

- System Issues: Sometimes, errors are not due to user mistakes but to temporary issues within the SWIFT network or the bank’s internal systems. This may involve temporary network outages or software glitches.

- Incorrect Account Number: While not directly related to the SWIFT code itself, an incorrect account number associated with the recipient can cause errors in the transaction process. The account number should be meticulously verified against the recipient’s records.

Troubleshooting Steps

A systematic approach to troubleshooting SWIFT code-related issues is essential. A methodical approach is often the most effective way to pinpoint the cause and implement a solution.

- Verify the SWIFT Code: Double-check the SWIFT code against the official bank website or a trusted financial resource. Ensure the code’s format and characters are accurate. A single typo can cause a significant problem.

- Review Transaction Details: Carefully examine all the details entered in the transaction form. Compare the bank name, address, and SWIFT code with the recipient’s information. Look for any inconsistencies or discrepancies.

- Contact the Recipient Bank: If the error persists after verifying the code, contact the recipient bank directly. They can provide confirmation of the correct SWIFT code and account details. This is often the most direct and effective method to resolve discrepancies.

- Consult Technical Support: If the issue stems from system-level problems, contact your financial institution’s technical support team. They can help identify and resolve technical problems.

- Document the Error: Keep a record of the transaction, error message, and steps taken to troubleshoot the issue. This will be useful for future reference and help resolve similar problems in the future.

Example of Errors and Solutions

Errors in SWIFT code use can be avoided with attention to detail. Here are examples of potential errors and how to solve them:

| Error | Solution |

|---|---|

| Incorrect SWIFT Code | Verify the SWIFT code against the bank’s official website or a reliable source. Correct the typo or use the correct code. |

| Bank Name Mismatch | Verify the bank name in the transaction with the recipient’s official records. Ensure a perfect match to avoid errors. |

| Transaction Failed with Error Code “XXX” | Consult the error code’s documentation. Contact your bank or the recipient bank for clarification. |

Incorrect SWIFT Code: Action Plan

If you discover that the provided SWIFT code is incorrect, follow these steps to rectify the situation:

- Immediately halt the transaction if it has not yet been processed. Do not proceed with an incorrect code.

- Locate the correct SWIFT code for the recipient bank. Use reliable sources like the bank’s website or a financial data provider.

- Update the transaction details with the correct SWIFT code and re-submit the transaction.

Last Point

So there you have it—your complete toolkit for navigating the world of international banking and the Abu Dhabi Commercial Bank SWIFT code. From understanding the basics to implementing security measures, this guide has you covered. Now you can confidently handle international transfers, knowing you have the right tools and knowledge. Stay safe and savvy!

Essential Questionnaire

What is a SWIFT code?

A SWIFT code is a unique 8, 11, or 16-character code used to identify banks globally. It’s crucial for secure international transactions.

How do I find the Abu Dhabi Commercial Bank SWIFT code?

The best way is usually checking the bank’s official website. You can also use reliable online financial resources.

What if the SWIFT code I found is incorrect?

Double-check! Use multiple sources to verify the code. If it’s wrong, the transfer might be rejected.

What are some common mistakes when using a SWIFT code?

Typos are a big one! Also, double-checking the recipient’s details and using a secure online platform are crucial.