GA life insurance practice exam free offers a valuable resource for aspiring insurance professionals seeking to bolster their knowledge and refine their skills. This comprehensive guide delves into the intricacies of these practice exams, exploring their diverse formats, key concepts, and effective strategies for maximizing their utility. From navigating the structure of the exam to understanding the common pitfalls, this exploration promises a profound understanding of the practical application of life insurance principles in Georgia.

The wealth of resources available, including detailed explanations of key concepts and illustrative examples, empowers the learner to confidently approach the actual GA life insurance licensing exam. The practical application of the learned concepts is emphasized, highlighting scenarios where this knowledge proves crucial in real-world situations. This study guide aims to transform the practice exam experience into a powerful learning tool, bridging the gap between theoretical knowledge and practical application.

Introduction to GA Life Insurance Practice Exams: Ga Life Insurance Practice Exam Free

GA life insurance practice exams are simulated tests designed to help aspiring insurance agents hone their knowledge and skills before taking the actual state licensing exam. These practice exams mimic the format and content of the official Georgia exam, providing a realistic experience for test-takers. They’re a crucial tool for gauging preparedness and identifying areas needing further study.These practice exams are more than just a way to review material.

They allow you to experience the pressure of a timed test environment, which is essential for success. Furthermore, they offer immediate feedback, pinpointing weak areas and reinforcing strong ones, ultimately increasing your chances of passing the real exam on your first try. This focused approach to learning is invaluable in the competitive field of life insurance.

Purpose and Benefits

Practice exams are designed to replicate the actual GA life insurance exam. This mirrors the exam’s structure, including question types, time constraints, and the overall format. By experiencing this simulated environment, test-takers can better gauge their understanding and identify knowledge gaps. This allows for targeted study and improvement before the official exam. This ultimately leads to increased confidence and preparedness.

Common Misconceptions

A common misconception is that practice exams are simply a waste of time. In reality, they offer invaluable support in exam preparation. Another misunderstanding is that the questions are exactly the same as the real exam. While the questions are similar in topic and format, the specific wording and examples will differ. The practice exams are designed to assess understanding and application, not rote memorization.

Finally, some believe that practice exams aren’t necessary if they’ve already studied thoroughly. While thorough study is essential, practice exams help solidify understanding, identify potential pitfalls, and boost confidence.

History of Practice Exams

The development of practice exams for GA life insurance licensing has paralleled the evolution of online learning and testing. Initially, practice exams were limited to books and study guides, often containing fewer questions and less detailed explanations. With the rise of the internet, practice exams became more accessible and interactive. This digital evolution has resulted in more sophisticated, comprehensive, and helpful tools for test preparation.

The focus has shifted from simply presenting questions to providing detailed explanations and scoring analyses. These tools continue to adapt to reflect changes in the exam’s content and format.

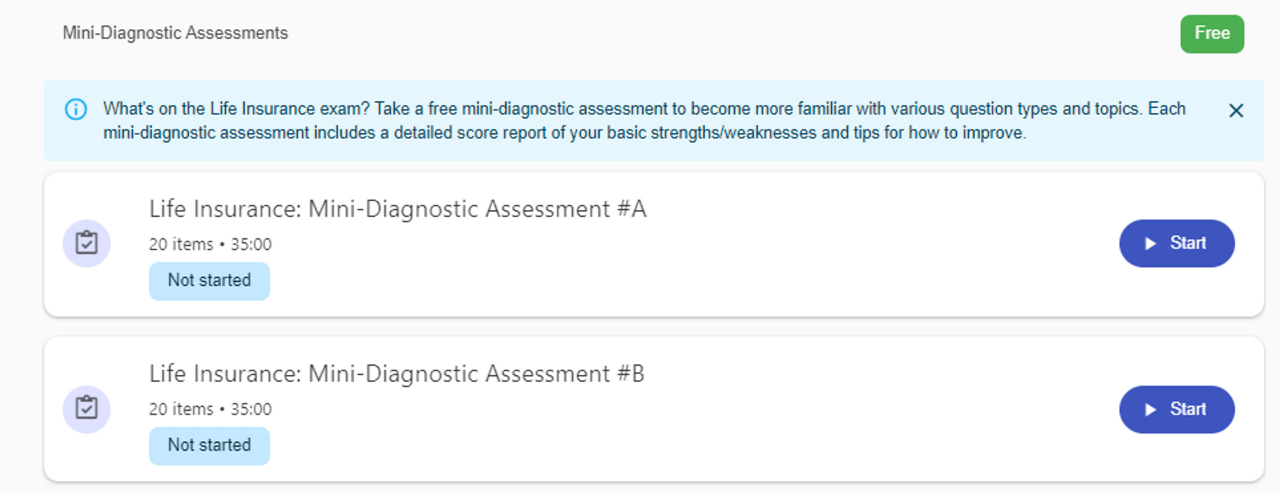

Types of Free Practice Exams Available

So, you’re looking to ace that GA life insurance exam? Free practice exams are a great way to test your knowledge and identify areas needing extra attention without breaking the bank. They come in various formats, each with its own pros and cons. Let’s dive into the different types available.Different formats offer various advantages and disadvantages. Online practice exams often allow for immediate feedback and tracking of progress, making them ideal for self-paced learning.

PDF formats, while offering flexibility, lack the interactive features found in online versions. Both have their place, and the best choice depends on your learning style and preferences.

Formats of Free Practice Exams

Free practice exams come in a variety of formats, each with its own set of benefits. Understanding the different formats can help you choose the best option for your study needs.

- Online Practice Exams: These exams are typically hosted on websites or learning platforms. They usually offer features like automated scoring, progress tracking, and detailed explanations for incorrect answers. This interactive nature allows for a more dynamic learning experience. Immediate feedback is a key benefit, allowing you to quickly identify weaknesses and focus your study efforts.

- PDF Practice Exams: These exams are downloadable files that you can complete on paper or using a computer. They often provide a good way to practice on the go or in situations without internet access. While often more straightforward, they usually lack the interactive elements of online versions, limiting the ability to get immediate feedback.

Strengths and Weaknesses of Each Format

A comparison of the strengths and weaknesses can aid in choosing the most suitable format.

| Format | Strengths | Weaknesses |

|---|---|---|

| Online | Immediate feedback, progress tracking, interactive elements, detailed explanations | Requires internet access, potential for technical issues |

| Accessible offline, flexible, relatively inexpensive | Lack of immediate feedback, less interactive, may require printing |

Topics Covered in Practice Exams

Practice exams cover a wide range of topics, mirroring the actual GA life insurance exam content. The goal is to prepare you for all potential scenarios and questions.

- Policy Types: Exam questions often cover different types of life insurance policies (term, whole life, universal life), their features, and associated benefits.

- Premium Calculation: Understanding how premiums are calculated is critical. Practice exams frequently assess your grasp of various factors influencing premium amounts.

- Policy Provisions and Riders: Questions frequently focus on understanding policy clauses, conditions, and riders. This ensures a comprehensive understanding of the nuances in the policies.

- Legal and Regulatory Compliance: This crucial aspect is frequently tested, focusing on the laws and regulations governing life insurance sales and operations.

- Financial Planning Concepts: The exam often incorporates elements of financial planning, including estate planning, risk management, and investment strategies. These components are vital for comprehensive preparation.

Reputable Sources for Free Practice Exams

Several reputable sources offer free practice exams to help candidates prepare for the GA life insurance exam. These resources often provide high-quality questions and explanations.

- Insurance Regulatory Organizations: State insurance departments frequently offer free study materials, including practice exams, to help candidates prepare.

- Online Learning Platforms: Many online learning platforms provide free or low-cost access to practice exams and study guides, which can help enhance learning and retention.

- Professional Organizations: Associations for insurance professionals sometimes offer practice materials, helping build a comprehensive understanding of the topics.

Key Concepts and Topics Covered

These practice exams are designed to equip you with a strong foundation in Georgia life insurance principles. They cover a wide range of crucial concepts, ensuring you’re well-prepared for the real exam. Understanding these concepts isn’t just about memorization; it’s about grasping the practical applications in real-world insurance scenarios.The practice exams delve into fundamental concepts such as policy types, premium calculations, beneficiary designations, and important legal considerations.

They mirror the actual exam’s structure and question styles, allowing you to identify areas needing more study. By practicing with these exams, you’ll gain confidence and familiarity with the material.

Policy Types and Their Characteristics

Understanding the different types of life insurance policies is essential for accurate calculations and client guidance. Each policy type has specific features, terms, and potential tax implications. This section covers the common types of policies and their key characteristics.

- Term life insurance provides coverage for a specific period. It typically has lower premiums than permanent life insurance, making it a cost-effective choice for those seeking temporary protection.

- Permanent life insurance, on the other hand, provides lifelong coverage. It builds cash value over time, offering both death benefit protection and investment opportunities. Common types include whole life, universal life, and variable life policies, each with unique features.

Premium Calculation Methods

The exams often test your ability to calculate premiums based on various factors. The process typically involves considering the insured’s age, health, lifestyle, and the desired coverage amount. Different policies have different premium calculation models.

- For term life insurance, premiums are usually fixed for the policy term. These premiums are calculated using actuarial tables that assess the risk of death at various ages.

- Permanent life insurance premiums are more complex, as they include both the cost of death protection and the accumulation of cash value. Factors such as interest rates and policy riders can influence the premium amount.

Beneficiary Designations and Legal Considerations

Understanding beneficiary designations is critical. Incorrect designations can lead to legal disputes and complications in claims settlements. The practice exams assess your understanding of these crucial elements.

- Beneficiary designations need to be clearly stated and updated as needed. The policy should explicitly name the beneficiary, and the process for changes should be understood. This avoids ambiguity and ensures the intended recipient receives the benefits.

- Important legal considerations involve estate planning, tax implications, and potential conflicts of interest. Policies may include provisions regarding the distribution of funds to beneficiaries and tax considerations that should be understood.

Common Exam Topics and Frequency

| Topic | Frequency of Appearance (Estimated) |

|---|---|

| Policy Types | High |

| Premium Calculations | High |

| Beneficiary Designations | Medium |

| Legal Considerations | Medium |

| Tax Implications | Low to Medium |

This table provides a general overview. The actual frequency may vary depending on the specific practice exam. Focus on understanding the concepts and applying them to various scenarios, rather than just memorizing frequencies.

Effective Strategies for Using Practice Exams

Practice exams are crucial for success in GA life insurance licensing. They aren’t just about getting a score; they’re a powerful tool for understanding your strengths and weaknesses, identifying areas needing more study, and ultimately, improving your chances of passing the exam on your first try. Using them effectively is key to maximizing their value.Effective practice exam usage is more than just passively taking a test.

It’s an active process that involves strategy and focused effort. By employing the right techniques, you can turn these practice sessions into valuable learning experiences that solidify your knowledge and boost your confidence.

Looking for a free GA life insurance practice exam? Good luck with your studies! If you’re in Melbourne for Christmas and need a place to grab a bite, check out the restaurants open in Melbourne on Christmas day. Plenty of options are available to keep your holiday plans on track, and this should give you a nice break to prepare further for your GA life insurance practice exam.

Maximizing the Value of Practice Exams, Ga life insurance practice exam free

Practice exams aren’t just about getting the right answers. They’re about understandingwhy* you got a particular answer right or wrong. Carefully analyzing your results is crucial for targeted study and improved performance. A simple review isn’t enough; you need a structured approach.

Effective Studying and Identifying Weak Areas

A key strategy for maximizing the value of practice exams is to analyze your performance meticulously. Review each question, not just the ones you answered incorrectly. Questions you answered correctly might reveal areas where your understanding is superficial. Consider why you got the answers right. Did you rely on memorization, or did you understand the underlying principles?

Identifying your weak areas allows you to focus your study efforts where they are most needed. For example, if you consistently struggle with calculating premiums, dedicate extra time to those specific calculations.

Looking for free GA life insurance practice exams? You might also need the claims phone number for Incline National Insurance, which you can find here: incline national insurance company claims phone number. Fortunately, these resources can help you prepare for your actual GA life insurance exam. Finding the right support materials is key to success.

Creating Personalized Study Plans Based on Practice Exam Results

Practice exam results provide a roadmap for creating a personalized study plan. Pinpoint the topics where you consistently struggle. This will help you tailor your study sessions to address these specific areas. Prioritize studying the materials that correspond to your weaker areas, reinforcing your knowledge base and improving your overall understanding.

The Importance of Practicing Under Timed Conditions

Practicing under timed conditions is essential. The GA life insurance exam is timed, and practicing in a similar environment helps you manage your time effectively during the actual exam. Familiarize yourself with the pressure of a timed environment to ensure you can maintain focus and pace. It also helps you identify any time management issues you might have, allowing you to adjust your approach.

For example, if you find yourself rushing through questions, consider taking breaks between sections to regain focus and composure.

Common Mistakes and How to Avoid Them

Cracking the GA Life Insurance practice exam requires more than just memorization; it demands understanding. Many test-takers stumble on the same common pitfalls. Recognizing these errors and developing strategies to avoid them can significantly improve your performance. This section delves into the most frequent mistakes and provides practical solutions.Identifying and correcting these common errors can dramatically improve your chances of success on the GA Life Insurance exam.

By understanding the reasons behind these mistakes, you can pinpoint your weak areas and focus your study efforts effectively.

Misinterpreting Policy Provisions

Incorrectly interpreting policy provisions is a prevalent error. Test-takers often miss subtle nuances in the language or focus on isolated clauses without considering the overall context. This leads to selecting the wrong answer.

- Carefully read the entire policy provision, paying close attention to the words used and the surrounding text. Avoid jumping to conclusions based on partial information.

- Break down complex policy provisions into smaller, more manageable parts. This allows you to understand each component in detail before evaluating the complete provision.

- Use examples or scenarios to clarify the application of policy provisions. This can help you grasp the practical implications and avoid abstract interpretations.

Ignoring Key Concepts in Calculations

Failing to apply the correct formulas and principles in calculations is another common mistake. This often results from a lack of understanding of the underlying concepts or a simple calculation error.

- Thoroughly review the relevant formulas and principles used in calculations. Understanding the rationale behind each formula is crucial to its correct application.

- Practice numerous calculation examples, paying close attention to the steps involved. Identifying and correcting errors in your practice problems will build confidence and prevent similar mistakes on the exam.

- Double-check your work for any mathematical errors or misunderstandings of the formula. Carefully verify your results to ensure accuracy.

Overlooking the Specifics of Different Policies

Different life insurance policies have unique features and requirements. Ignoring these specifics often leads to selecting incorrect answers.

- Focus on understanding the specific details of each type of policy, including term life, whole life, universal life, etc. Identify the key characteristics that differentiate each policy.

- Create a table comparing and contrasting different policies to highlight the distinctions. This can help you remember the unique aspects of each policy.

- Practice questions that test your knowledge of various policy types and their characteristics. This reinforces your understanding and helps avoid confusion.

Common Mistakes and Their Solutions

| Common Mistake | Reason | Solution |

|---|---|---|

| Misinterpreting policy provisions | Focusing on isolated clauses, missing subtle nuances | Carefully reading the entire provision, breaking it down, and using examples. |

| Ignoring key concepts in calculations | Lack of understanding, calculation errors | Thorough review of formulas, practice problems, and double-checking calculations. |

| Overlooking specifics of different policies | Failure to differentiate between policies | Focus on the unique features of each policy type and creating comparisons. |

Practical Application of Knowledge

So, you’ve tackled the practice exams, grasped the concepts, and now you’re ready to apply that knowledge. This isn’t just about passing a test; it’s about understanding how life insurance principles work in the real world. Let’s dive into how this knowledge translates into tangible benefits and crucial decision-making.Understanding life insurance principles isn’t just for actuaries; it’s a skill that benefits everyone.

From personal financial planning to career advancement, the core concepts are incredibly useful. Think about it – you’re learning how to evaluate risk, calculate premiums, and understand the value of different policy types. These aren’t just abstract ideas; they’re the foundation of smart financial choices.

Real-Life Scenarios Requiring Life Insurance Knowledge

Navigating life’s financial hurdles often necessitates a solid grasp of life insurance. Whether it’s securing a mortgage, planning for retirement, or ensuring your loved ones’ financial future, life insurance plays a vital role. Consider these situations:

- Estate Planning: Life insurance policies can serve as a crucial element in estate planning. They can provide a lump-sum payment to cover debts, taxes, and provide financial support to beneficiaries, minimizing the impact of your passing on your family.

- Business Ownership: For business owners, life insurance can provide funds to cover business debts or ongoing operations if the owner passes away. This continuity can safeguard the business’s future.

- Debt Protection: Life insurance can help alleviate the financial burden of outstanding debts, ensuring that loved ones are not burdened with large amounts of debt after your passing.

- Financial Security for Dependents: Life insurance is an essential tool for providing financial security for your spouse and children in the event of your untimely demise. This security protects them from financial hardship and ensures they can maintain their current lifestyle.

Career Advancement Opportunities

The knowledge gained from life insurance practice exams can significantly benefit your career path, especially in related fields.

- Financial Advisors: A deep understanding of life insurance principles is paramount for financial advisors. They can offer tailored recommendations to clients based on their individual needs and financial situations, maximizing the value of life insurance for each client.

- Insurance Agents: Agents benefit from a strong foundation in life insurance by accurately assessing clients’ needs and proposing the most appropriate policies. They can then effectively communicate the complexities of various plans and policies to clients, ensuring they understand the choices they are making.

- Business Development: Even outside the insurance sector, understanding life insurance can be helpful in business development roles. It helps to assess risk and plan for the financial consequences of various scenarios, which is a valuable asset in strategic planning.

Case Study: The Smith Family

The Smith family owned a small business. Mr. Smith, the sole proprietor, passed away unexpectedly. His business was in significant debt, and his wife and children were left with little financial security. Without adequate life insurance coverage, the business likely would have had to close, leaving the family in a precarious financial position.

A robust life insurance policy would have provided the funds needed to cover outstanding debts, maintain the business, and provide the family with a safety net during this difficult time.

The Smith family’s experience highlights the critical role life insurance plays in protecting families and businesses from financial ruin.

Exam Structure and Question Types

GA life insurance practice exams, like many standardized tests, follow a predictable structure. Understanding this structure can significantly improve your preparation and performance. Knowing the types of questions and their frequency allows you to tailor your study approach to specific areas.The exams are designed to assess your comprehension of key concepts, your ability to apply them, and your knowledge of relevant regulations and guidelines.

The structure is not random; it reflects the importance of different aspects of the subject matter.

Typical Exam Structure

The practice exams generally follow a pattern of gradually increasing difficulty. Early sections focus on foundational concepts, progressing to more complex applications and case studies. This structure mirrors the actual exam experience, allowing you to build confidence as you work through the material. You can expect a balance of conceptual understanding and practical application.

Question Types

Practice exams use a variety of question types to assess different learning objectives. The mix of question types ensures a comprehensive evaluation of your understanding.

- Multiple Choice: This is the most common question type, presenting you with several options and requiring you to select the correct one. These questions typically test your recall of facts, understanding of concepts, and ability to apply knowledge.

- True/False: These questions evaluate your ability to distinguish between accurate and inaccurate statements. They often assess your grasp of fundamental principles.

- Matching: Matching questions pair items from two lists. This type of question tests your ability to correlate information and identify relationships.

- Short Answer/Essay: These questions require a written response. They often focus on your ability to apply concepts, explain complex ideas, and support your reasoning with evidence. They are less common than multiple choice questions in practice exams.

- Scenario-Based Questions: These questions present a real-life insurance scenario. You are required to identify the correct course of action or the relevant legal principles. These types of questions are designed to test your practical application of knowledge in a realistic setting.

Question Type Proportions

The following table provides a general representation of the proportion of different question types in GA life insurance practice exams. Keep in mind that these proportions can vary slightly from one practice exam provider to another.

| Question Type | Approximate Proportion (%) |

|---|---|

| Multiple Choice | 60-75 |

| True/False | 10-20 |

| Matching | 5-10 |

| Short Answer/Essay | 5-10 |

| Scenario-Based | 5-10 |

Exam Patterns and Trends

A significant pattern is the consistent emphasis on multiple-choice questions. This indicates that the majority of the exam assesses your ability to quickly identify the correct answer from several choices. The inclusion of other question types ensures a more comprehensive evaluation. Scenario-based questions are also becoming more frequent in practice exams, reflecting the growing importance of practical application in the insurance industry.

These patterns can be used to guide your study strategy, focusing more time on areas where multiple-choice questions dominate.

Resources and Further Learning

So, you’ve tackled the practice exams, and now you’re ready to dive deeper into GA life insurance. This section provides valuable resources to solidify your understanding and boost your confidence. We’ll explore websites, articles, and study guides that offer additional perspectives and examples.

Additional Learning Resources

Beyond these practice exams, numerous resources can enhance your knowledge and understanding of GA life insurance. This includes a variety of materials, from comprehensive textbooks to online tutorials, designed to make the learning process engaging and informative.

- State Insurance Departments: Each state’s insurance department provides crucial information about licensing requirements, regulations, and relevant legislation. These resources are often invaluable for staying up-to-date with current rules and regulations in Georgia. Direct access to these departments provides critical insights into the specifics of GA insurance policies.

- Industry Publications: Publications like the “Journal of Risk and Insurance” and similar industry journals often feature articles on the latest trends, innovations, and emerging challenges in the life insurance sector. They provide a broader perspective and help you stay informed on current issues.

- Professional Organizations: Membership in professional organizations like the American Life Insurance Association can offer access to additional educational materials, networking opportunities, and insights into the industry. These organizations frequently host webinars, workshops, and conferences that delve into specialized topics within life insurance.

- Online Courses and Tutorials: Numerous online platforms offer courses and tutorials specifically focused on life insurance. These resources often provide interactive exercises and assessments to reinforce learning. Some even offer certificates upon successful completion, adding credibility to your professional development.

- Textbooks and Study Guides: Comprehensive textbooks and study guides provide in-depth coverage of life insurance principles, regulations, and practices. These resources are particularly helpful for gaining a thorough understanding of the theoretical underpinnings of life insurance and its applications.

Effective Utilization of Resources

To make the most of these resources, consider these strategies:

- Targeted Approach: Don’t just browse aimlessly. Identify specific areas where you need more clarification or practice. Focus on those resources designed to address those particular needs.

- Active Learning: Don’t just passively read or listen. Take notes, work through examples, and actively engage with the material. This will help you retain the information more effectively.

- Cross-Reference: Compare information from different sources to solidify your understanding. If multiple resources explain a concept in similar ways, you can be more confident in your grasp of the material.

- Time Management: Allocate specific time slots for studying these resources, just like you would for your practice exams. Consistent study habits will yield better results.

- Seek Clarification: If you encounter anything unclear, don’t hesitate to reach out to mentors, colleagues, or online forums for assistance. Clearing up ambiguities will help you avoid misunderstandings.

Resource Summary Table

| Resource | Strengths |

|---|---|

| State Insurance Departments | Provides specific regulations and licensing requirements for Georgia, crucial for GA life insurance. |

| Industry Publications | Offers insight into industry trends and challenges, keeping you informed about the latest developments in life insurance. |

| Professional Organizations | Provides access to educational resources, networking opportunities, and insights into the industry. |

| Online Courses/Tutorials | Offers interactive learning experiences and assessments, reinforcing understanding through practice and feedback. |

| Textbooks/Study Guides | Provides in-depth coverage of life insurance principles and practices, strengthening fundamental knowledge. |

Final Wrap-Up

In conclusion, the GA life insurance practice exam free serves as a critical stepping stone for aspiring insurance professionals. By understanding the various formats, mastering key concepts, and adopting effective strategies, individuals can significantly improve their chances of success. This guide has presented a multifaceted approach to utilizing these practice exams, from their historical context to their real-world applications.

Ultimately, this resource empowers individuals to navigate the complexities of life insurance in Georgia, setting them on a path toward professional achievement.

Clarifying Questions

What are the most common question types in the GA life insurance practice exams?

The exams typically incorporate multiple-choice, true/false, and possibly matching questions, mirroring the format of the actual licensing exam. The frequency of each type may vary, so thorough preparation across all formats is crucial.

How can I effectively identify my weak areas in the practice exams?

Carefully review each question you answer incorrectly, paying close attention to the specific concepts tested. Identify patterns in the questions you miss and focus your study time on these areas. Utilizing practice exam results to create personalized study plans is highly recommended.

Are there any specific study guides or resources that are highly recommended for preparation?

Numerous reputable sources offer practice exams and study materials. Consult with educational institutions or professional organizations related to insurance licensing for guidance on credible resources.

What is the typical structure of the GA life insurance practice exams?

The structure of the practice exams often mirrors the actual exam, with sections focusing on various aspects of life insurance. A clear understanding of the exam structure allows you to allocate time effectively during the practice session.