How long does it take to get insurance card – How long does it take to get an insurance card? This crucial question often arises when navigating the insurance application process. The time frame varies significantly depending on several factors, including the type of insurance, the application method, and potential delays. Understanding these factors is key to managing expectations and ensuring a smooth experience.

Different insurance types, like health, auto, and life, have varying processing times. Online applications generally offer quicker turnaround times compared to traditional in-person methods. The accuracy and completeness of submitted documents also play a vital role in the processing timeline. Read on to discover the nuances and factors affecting the time it takes to receive your insurance card.

Insurance Types and Processing Times: How Long Does It Take To Get Insurance Card

Getting the right insurance can be a real headache, especially when you’re trying to figure out how long it’ll take to get your card. Different types of insurance have different processing times, and a bunch of factors can affect how long it takes. Let’s dive into the nitty-gritty!Different insurance types have different processing times, which can vary depending on the application method and the specific circumstances.

Factors like your credit history, medical history, or driving record can also play a role. Knowing the typical times can help you plan ahead.

Different Insurance Types and Processing Times

Insurance comes in many flavors, from protecting your health to safeguarding your car or your future. Each type has its own typical processing timeframe.

- Health Insurance: Typical processing times for health insurance applications range from a few days to a couple of weeks. This depends heavily on whether you’re applying online or in person, and whether there are any extra documents needed. Online applications often move faster, but in-person applications can sometimes be faster if everything is readily available.

- Auto Insurance: Getting auto insurance is usually pretty quick. Expect processing times to be a few days to a week for online applications and a bit longer (maybe a couple of extra days) for in-person applications. The time can depend on the accuracy of the information you provide.

- Life Insurance: Life insurance applications typically take longer than auto or health insurance, ranging from a few weeks to several months. This is because of the thorough underwriting process, which involves checking things like your health history and lifestyle.

- Homeowners Insurance: Processing times for homeowners insurance usually fall within a week to a month, depending on the details of your application and any needed assessments. Like auto insurance, this can depend on the accuracy of the information you provide and any additional documents required.

Factors Affecting Processing Times, How long does it take to get insurance card

Numerous factors can influence how long it takes to get your insurance card. These include the insurance company, the complexity of your application, and the information you provide.

Getting an insurance card can take a bit of time, but it’s important to be patient. It’s often a few weeks, but sometimes it can take a little longer. If you’re looking for a delicious meal while you wait, check out the menu at Restaurant Prince Pizzeria Sorel, here. They’ve got a great selection, and it’ll help pass the time while you await your card.

Hopefully, the process won’t take too long, but it’s always good to be prepared!

- Application Method: Online applications often have faster processing times than traditional in-person applications. This is because online systems can process information more efficiently.

- Completeness of Application: Providing all necessary documents and information accurately and completely speeds up the process. Incomplete or inaccurate information can cause delays.

- Underwriting Process: This is a crucial step where the insurance company evaluates your risk profile. More complex or extensive underwriting processes can take longer.

- Insurance Company Policies: Different insurance companies have varying processing procedures, so this will influence the time it takes to receive your card.

Comparison of Processing Times

Here’s a table summarizing typical processing times for various insurance types, considering the application method and potential delays:

| Insurance Type | Application Method | Typical Processing Time | Potential Delays |

|---|---|---|---|

| Health | Online | 2-4 business days | Incomplete information, medical reports |

| Health | In-Person | 3-7 business days | Missing documents, additional verification |

| Auto | Online | 1-3 business days | Verification of driving history |

| Auto | In-Person | 3-5 business days | Late submission of documents |

| Life | Online | 4-12 weeks | Complex health issues, extensive underwriting |

| Life | In-Person | 6-14 weeks | Missing medical reports, additional questions |

| Homeowners | Online | 5-10 business days | Property valuation, home inspection |

| Homeowners | In-Person | 7-14 business days | Missed appointments, home assessment |

Application Method Impact

Applying for insurance can be a breeze, but the way you apply can seriously impact how quickly you get your card. Whether you’re a tech whiz or prefer face-to-face interaction, the method you choose will affect the processing time. Let’s dive into the nitty-gritty details of each application method.The choice of application method—online, phone, or in-person—directly affects the time it takes to receive your insurance card.

Different methods involve varying levels of interaction and paperwork, which ultimately influences the processing speed. Understanding these differences can help you make a more informed decision.

Online Application Method

Online applications are super convenient and often the fastest way to get started. You can complete the application at your own pace, anytime, anywhere with a stable internet connection. This usually involves filling out forms, uploading documents, and providing necessary details. Processing times for online applications can vary depending on the insurance provider, but generally tend to be quicker than in-person applications, sometimes taking as little as a few days.

Phone Application Method

Applying via phone is a good option if you prefer talking to a human. A dedicated representative can guide you through the application process step-by-step, answering any questions you might have. This method is especially helpful for those who are not comfortable navigating online applications. However, phone applications often involve a series of calls and interactions, leading to a slightly longer processing time than online applications.

Expect processing times to usually be a bit longer than online, perhaps a week or two.

In-Person Application Method

Applying in person is ideal for those who prefer a hands-on approach and need immediate clarification. This involves visiting a physical branch, meeting with an agent, and providing all the necessary documents. While this method offers immediate support, the processing time is generally the longest. It often takes longer, potentially a couple of weeks, depending on the insurance provider and the complexity of your application.

Comparison of Application Methods

| Method | Advantages | Disadvantages | Estimated Processing Time |

|---|---|---|---|

| Online | Convenience, speed, flexibility, often available 24/7. | Requires reliable internet, potential for errors if not careful, less direct support. | 3-7 business days |

| Phone | Direct human interaction, personalized assistance, easier for those who are less tech-savvy. | Processing can be slower due to multiple calls, waiting times, and potential for miscommunication. | 7-14 business days |

| In-Person | Immediate support, direct verification of documents, face-to-face clarification. | Limited availability, requires travel time and scheduling, often longer processing times. | 10-21 business days |

Factors Affecting Processing Time

Getting your insurance card can sometimes feel like a marathon, not a sprint. Various factors can impact how long it takes to get your hands on that crucial document. Understanding these factors can help you anticipate potential delays and stay prepared.

Common Causes of Delays

Several reasons can contribute to delays in receiving your insurance card. These range from seemingly simple issues to more complex bureaucratic processes. It’s important to be aware of these potential roadblocks to avoid unnecessary stress.

- Incomplete or inaccurate documents: Providing all the required paperwork accurately is key. Missing or incorrect information can significantly slow down the processing. Think of it like a puzzle – every piece needs to be in place for the full picture to emerge. For example, a wrong date of birth or a photocopy of a document that’s not clear enough could cause the process to halt.

- Verification processes: Insurance companies have stringent verification procedures to ensure the legitimacy of your application. These checks, while crucial for security, can sometimes lead to delays. It’s like going through airport security – it’s necessary, but it can take time.

- System issues: Technology plays a massive role in modern insurance processes. Technical glitches, system overload, or database errors can cause delays in processing your application. Imagine a huge traffic jam on the internet highway – that’s what system issues can feel like.

- High volume of applications: During peak seasons or times of increased demand, insurance companies may experience a surge in applications. This can lead to longer processing times. It’s similar to a popular restaurant on a busy weekend – you have to wait longer for your food.

- Policy and procedure variations: Different insurance companies have unique policies and procedures. Some may have more stringent requirements or take longer to process applications than others. It’s like comparing different stores’ return policies – some are more lenient than others.

Impact of Document Accuracy

The accuracy and completeness of the documents you submit directly affect processing time. Think of it as building a house – if the foundation isn’t solid, the whole structure will be compromised.

- Accurate Information: Providing correct information like your date of birth, address, and contact details prevents errors and ensures a smoother application process. It’s like following a recipe precisely – accurate measurements lead to a delicious dish.

- Clear Documentation: Submitting clear copies of documents, such as identification cards and proof of address, avoids delays due to illegible or unclear information. This is like presenting a legible signature in a contract – it avoids misunderstandings.

- Comprehensive Requirements: Ensuring you’ve submitted all required documents, and not just some of them, avoids unnecessary back-and-forth communication. It’s like having all the necessary ingredients for a recipe.

Influence of Insurance Company Policies

Insurance companies have internal policies and procedures that influence processing timelines.

- Internal Processes: Different insurance companies have different internal processes, some may be more efficient than others. It’s like comparing different ways to cook a meal – some recipes are faster and easier than others.

- Claim Handling Procedures: The handling of claims, while separate from the application process, can also indirectly influence the processing time for new applications. It’s like a chain reaction – delays in one area can affect another.

Flowchart of Application Process and Potential Delays

Imagine a flowchart like a roadmap for your application. It Artikels the steps and possible delays at each stage. A delay at any point in the process can extend the overall time it takes to get your insurance card. The more accurate and complete your documents are, the smoother and faster this process will be.

Typical Processing Time Ranges

Getting your insurance card can feel like waiting for a snail to race a tortoise. But fear not, Pontianak peeps! Knowing the typical processing times for different insurance types and application methods can help you plan your next moves. We’ll break it down so you can chill and not stress.

Processing Time Variations

Insurance processing times are like the weather—they vary, and there are lots of factors that influence the speed. Some applications breeze through, while others take a bit longer. It all depends on the type of insurance, how you apply, and even the specific insurance provider.

Typical Processing Time Ranges by Insurance Type and Application Method

Different insurance policies have different hoops to jump through. The complexity of the policy affects the time it takes to process your application. Some policies, like health insurance, need more scrutiny than, say, a simple travel insurance policy. And the application method matters too—expedited applications often get prioritized. Here’s a table to give you a general idea:

| Insurance Type | Application Method | Processing Time Range |

|---|---|---|

| Health Insurance | Online | 5-15 business days |

| Health Insurance | Paper-based | 7-21 business days |

| Health Insurance | Expedited | 2-7 business days (dependent on provider and case specifics) |

| Auto Insurance | Online | 2-7 business days |

| Auto Insurance | Paper-based | 5-14 business days |

| Travel Insurance | Online | 1-3 business days |

| Travel Insurance | Paper-based | 3-7 business days |

| Life Insurance | Online | 15-30 business days |

| Life Insurance | Paper-based | 21-45 business days |

| Life Insurance | Expedited | (not usually offered, requires special circumstances) |

Note: These are just estimated ranges. Actual processing times may vary depending on individual circumstances and the specific insurance provider. Things like incomplete forms, additional documentation requests, or complex claims can lengthen the process.

Examples of Average Processing Times in Different Scenarios

Let’s say you apply for health insurance online during a busy season; you might experience a slight delay compared to applying during a quieter period. If your auto insurance claim involves a complex accident with multiple parties, the processing time will likely be longer than a simple fender bender. An expedited application for travel insurance, for example, for a last-minute trip might speed things up, but it’s not a guaranteed quick process.

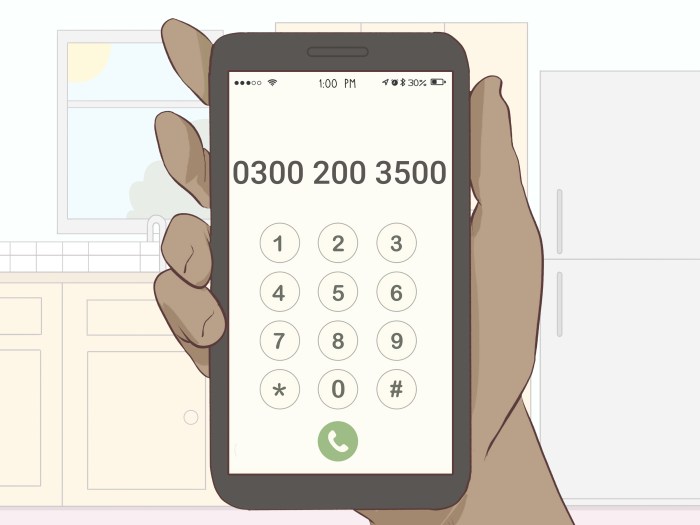

Getting your insurance card can sometimes take a while, but it’s usually not too long. If you need immediate assistance, you can always call Columbia Insurance Group at columbia insurance group phone number for faster processing and clarification on the timeframe. They’ll be able to give you a more precise idea of how long it will take to receive your card.

Expedited Processing Options

Hey Pontianak peeps! Getting your insurance card ASAP is totally understandable. Sometimes, you need it stat! Luckily, many insurance providers offer expedited processing options, but it ain’t always a freebie. Let’s dive into the details.Expedited processing, in simple terms, is a faster way to get your insurance card. It’s a service designed for situations where a quicker turnaround time is crucial.

Think of it like ordering a super-fast delivery for your insurance documents! This service comes with extra charges, so it’s important to weigh the pros and cons.

Available Expedited Processing Options

Different insurance providers may offer various expedited processing options. Some common methods include:

- Priority Processing: This is a basic expedited option that usually involves a small extra fee and a faster review of your application. It’s like bumping your application up the queue, ensuring it gets processed sooner than the standard queue.

- Rush Processing: This option provides an even faster turnaround time compared to priority processing, often with a higher fee attached. Imagine your application is on a super express lane, cutting through the regular lines.

- Urgent Processing: This is the fastest option, with the highest associated fee. It’s like a VIP lane, guaranteeing your application is processed as quickly as possible. Use this if you absolutely need your insurance card ASAP.

Circumstances Qualifying for Expedited Processing

There are certain situations that might make expedited processing a viable choice.

- Emergency Situations: If you’ve just had a major accident or need insurance coverage immediately, urgent processing could be a game-changer. Think about a sudden health crisis or a crucial travel plan requiring immediate insurance protection.

- Time-Sensitive Events: A looming deadline for a major event, like a wedding or a new job, might qualify for expedited processing. If your new job requires you to have insurance coverage by a specific date, expedited processing is a great option.

- Specific Insurance Needs: Some insurance types might need quicker processing, like travel insurance for a short trip or a specialized policy for a new venture. The nature of your insurance needs could also trigger expedited processing.

Additional Fees or Requirements

Expedited processing usually comes with extra costs. The fees can vary greatly depending on the chosen processing level and the insurance provider. You’ll often have to pay a premium to access the express lane.

- Additional Fees: Expect to pay a fee on top of the standard application fee for expedited processing. This fee is often a fixed amount or a percentage of the total insurance premium.

- Faster Application Processing: There are usually stricter requirements for eligibility, and your application must meet specific criteria to qualify.

Comparison of Processing Times

Expedited processing significantly reduces the processing time compared to standard processing. You’ll get your insurance card much faster than the standard time. Here’s a simplified comparison:

| Processing Type | Typical Time Range (Estimate) |

|---|---|

| Standard Processing | 10-30 days |

| Priority Processing | 5-15 days |

| Rush Processing | 3-7 days |

| Urgent Processing | 1-3 days |

Procedures for Requesting Expedited Processing

The procedures for requesting expedited processing can vary from one insurance provider to another. It’s essential to contact the insurance provider directly to get the correct procedure.

- Contact the Insurance Provider: You need to reach out to the insurance provider to initiate the expedited processing request.

- Follow Instructions: They’ll guide you on how to proceed with the expedited request. Make sure you have all the necessary documents ready to submit.

- Confirmation and Tracking: Once you submit your request, you’ll likely receive a confirmation or tracking number to monitor the progress.

Tracking Application Status

Keeping tabs on your insurance application is crucial, like checking on a plant to make sure it’s growing right. Knowing the status helps you stay in the loop and avoid unnecessary worries. It’s all about peace of mind, and knowing where things stand.Knowing the status of your insurance application is important to manage expectations and keep track of the process.

This allows you to be proactive and address any issues that may arise. It’s like having a roadmap for your insurance journey.

Methods for Checking Application Status

Knowing how to check the status of your application is super important. It keeps you updated on the progress of your application, and it helps to avoid any unwanted surprises.

- Online Portal: Most insurance providers have a dedicated online portal where you can log in and view the status of your application. It’s like a digital dashboard showing you where you are in the process. Just look for the “Application Status” or similar section. This is usually the easiest and fastest method. For example, if you applied through their website, there’s often a login area to track progress.

- Customer Service: If you prefer talking to a real person, you can contact the insurance provider’s customer service department. They can provide you with real-time updates on your application. This is a great option if you need personalized help or have questions. You can reach them via phone or email. Expect to have your policy number handy to expedite the process.

- Email Updates: Some insurance providers send email updates on the status of your application. Be sure to check your inbox regularly for any important updates. This is a handy way to be informed about the application’s progress without actively seeking it.

Steps to Contact Customer Service

Contacting customer service for updates is like getting a personalized status report. Here’s a simple guide on how to do it smoothly:

- Gather Information: Have your policy number, application number, and any other relevant details ready. This will help them locate your application quickly.

- Choose Your Contact Method: Decide whether to call or send an email. Each method has its pros and cons. Consider your preference and what information you need quickly.

- Explain Your Need: Clearly explain that you want to check the status of your insurance application. Be polite and clear. A simple and direct approach usually works best.

- Record Information: Take notes of the conversation or any updates provided. This way you have a record of the information you’ve received.

Using the Insurance Provider’s Online Portal

The insurance provider’s online portal is like a personalized dashboard for your insurance application. Here’s how to use it effectively:

- Log in: Access the online portal using your login credentials. These are usually the same as your account details for their website.

- Find Application Section: Look for the application status section or a similar tab. It might be in a specific section of the portal or under the “My Account” area.

- Review Status: Review the status of your application. This usually displays a clear summary of the application’s current stage. Some might even include a timeline.

Common Problems and Solutions

Getting your insurance card can be a bit of a hassle sometimes, but don’t worry, we’ve got your back! We’ll break down the common bumps in the road and how to navigate them like a pro. Knowing the potential issues and how to fix them will save you a whole lot of head-scratching.Understanding the potential snags in the insurance application process is key to a smoother experience.

This section details common problems that can delay your card issuance and provides solutions to help you get back on track. It’s all about being prepared and knowing your rights.

Identifying Potential Roadblocks

Knowing the potential issues ahead of time is like having a secret weapon. This will help you stay calm and avoid unnecessary stress. Problems can crop up for various reasons, from simple paperwork errors to more complex issues. Being aware of these potential hiccups will help you avoid costly delays and ensure a smoother process.

Troubleshooting Common Problems

It’s super important to stay on top of things throughout the whole application process. Keeping accurate records and being diligent about the details can make a world of difference. Here’s a breakdown of common problems and how to tackle them:

| Problem | Cause | Solution |

|---|---|---|

| Missing Documents | Forgot to submit a required form, or perhaps an important document was misplaced. | Resubmit the missing documents as soon as possible. Contact customer service to confirm the exact documents needed. Maintain a file of all submitted documents for future reference. |

| Incorrect Information | Mistakes in filling out forms, or perhaps a typo. | Correct the mistake immediately. Contact customer service to explain the situation and request a correction. Double-check all information before submitting any form to prevent future issues. |

| Delayed Processing | A backlog of applications, or issues with the processing system. | Contact customer service to inquire about the status of your application. They can provide updates and potentially expedite the process. Be patient and understanding that these situations can sometimes happen. |

| Incomplete Application | Missing information in the application, perhaps you forgot to answer some sections. | Review the application carefully and complete all sections. Contact customer service if you’re unsure about anything. |

Maintaining Accurate Records

Keeping a detailed record of all your interactions, submitted documents, and communications is absolutely crucial. This is like having a personal logbook for your insurance application journey. This ensures everything’s on track and you have proof of your actions if needed. It’s like having a safety net.

Resolving Issues with Incomplete or Incorrect Information

If you find errors or omissions in your application, it’s vital to address them promptly. Don’t let small mistakes derail your entire process. Immediately contact customer service, explain the situation, and request assistance in correcting the errors. Correcting the information accurately is essential for a swift resolution. Double-checking is your best friend!

Final Wrap-Up

In conclusion, obtaining an insurance card involves a multifaceted process with varying timelines. Understanding the factors that influence processing times, such as the chosen application method and potential delays, empowers you to manage your expectations effectively. Expedited options are available for urgent needs. By following the steps for tracking your application status, you can stay informed about its progress.

Addressing potential problems promptly is crucial for a smooth and timely issuance of your insurance card.

Top FAQs

How long does it typically take to get a health insurance card?

Processing times for health insurance cards generally range from a few days to several weeks, depending on the application method and the insurance provider.

What documents are typically required for an insurance application?

The specific documents needed vary by insurance type and provider. Common requirements include identification documents, proof of address, and income verification.

Can I track the status of my insurance application online?

Many insurance providers offer online portals for tracking application progress. Check with your specific provider for details on how to access and use this service.

What are the common reasons for delays in receiving an insurance card?

Delays can stem from missing or inaccurate documents, verification issues, system glitches, or provider-specific policies.