Insurance points vs DMV points – understanding these crucial concepts is essential for any driver. This guide delves into the nuances of each system, explaining how they work, their impact on your wallet and driving privileges, and how to navigate the process of recovering from points.

The article explores the fundamental differences between insurance points, which affect your car insurance premiums, and DMV points, which impact your driving license. It provides clear examples of traffic violations and accidents that lead to points accumulation in each system. Moreover, it details the potential consequences of accruing points, from increased insurance costs to license suspensions, offering practical advice on how to avoid them and what to do if you’ve already accumulated points.

Introduction to Insurance Points and DMV Points

Understanding insurance points and DMV points is crucial for maintaining a safe driving record and avoiding financial penalties. These points track driving infractions, impacting both your ability to renew your license and your auto insurance premiums. Knowing the difference between the two systems is vital for proactive driving habits.Insurance points and DMV points are distinct systems that track different aspects of driving behavior.

Insurance points primarily affect your auto insurance premiums, while DMV points impact your ability to renew your driver’s license. They both, however, stem from similar infractions, such as speeding or traffic violations.

Distinction Between Insurance Points and DMV Points

Insurance points are assessed by your auto insurance company, while DMV points are recorded by the Department of Motor Vehicles (DMV). Insurance companies use these points to adjust your premiums, while the DMV uses them to determine eligibility for driver’s license renewal. A key distinction lies in the specific infractions that trigger each type of point. While some violations may result in points in both systems, others might only affect one or the other.

How Each Point System Works

Insurance companies typically have a point system where each violation accrues a certain number of points. Accumulating a specific number of points can lead to a significant increase in your insurance premiums. DMV point systems work similarly, but the impact is on your driver’s license and eligibility for renewal. Each state’s DMV has its own point system and associated penalties.

For example, a speeding ticket might earn three insurance points and two DMV points in one state, but the exact numbers vary.

Potential Consequences of Accumulating Points

Accumulating points in either system can have serious repercussions. High insurance points can lead to substantial premium increases, making insurance more expensive. DMV points can result in license suspension or even revocation, impacting your ability to drive legally. For example, a driver accumulating 12 points in a year in a certain state might face a 30-day license suspension.

Moreover, a series of points over a specific period can trigger an automatic review of your driving record.

Comparison of Insurance Points and DMV Points

| Point Type | Description | Impact |

|---|---|---|

| Insurance Points | Points assigned by your insurance company for driving violations. | Increased insurance premiums, potentially higher rates. |

| DMV Points | Points assigned by the Department of Motor Vehicles (DMV) for driving violations. | Suspension or revocation of driver’s license, difficulty renewing license. |

Sources of Insurance Points

Insurance points, a crucial component of your driving record, directly impact your car insurance premiums. Understanding the sources of these points is essential for responsible driving and maintaining a favorable insurance rate. Knowing what actions lead to point accumulation helps you avoid costly penalties.Accumulating insurance points is often a consequence of traffic violations. These violations, ranging from minor infractions to serious offenses, can have a cascading effect on your driving privileges and financial well-being.

Properly understanding the specific violations that trigger points is crucial for proactive decision-making on the road.

Common Reasons for Receiving Insurance Points

A variety of actions can result in the addition of insurance points to your driving record. These actions typically involve failing to adhere to traffic regulations or engaging in unsafe driving practices. It’s essential to prioritize safety and follow all traffic laws to avoid unnecessary point accumulation.

Specific Examples of Traffic Violations

Certain traffic violations are more likely to lead to insurance points. These violations often involve speeding, running red lights, or failing to obey traffic signs. For instance, speeding significantly increases the risk of accidents and often carries substantial point penalties. Similarly, running a red light can cause collisions and endanger other road users. Avoiding such violations is vital for maintaining a clean driving record.

How Accidents or Moving Violations Contribute to Point Accumulation

Accidents and moving violations are significant contributors to the accumulation of insurance points. Accidents, regardless of fault, often result in points being assessed. Moving violations, such as failing to signal, improper lane changes, or driving under the influence, also lead to insurance point accumulation. Proactive adherence to traffic laws and safe driving practices minimizes the risk of such occurrences.

Table of Violations and Point Values

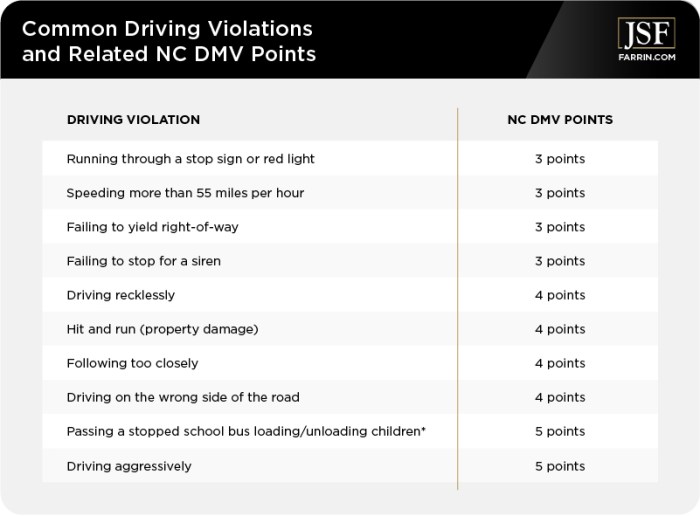

Understanding the potential point values for different violations can help drivers proactively avoid accumulating points. This table provides a concise overview of common violations and their corresponding point values. Remember that point values can vary by state and jurisdiction. Always check with your local DMV for the most accurate information.

Yo, like, insurance points vs DMV points, right? It’s all a bit of a headache, ain’t it? Plus, if you’re dealing with billing issues, like ‘incident to billing commercial insurance pa’ incident to billing commercial insurance pa , it can totally mess up your whole driving record. So, basically, knowing the difference between those points is crucial for avoiding a total driving ban.

Right?

| Violation | Points | Description |

|---|---|---|

| Speeding (10-15 mph over limit) | 3-5 | Driving more than 10-15 mph above the posted speed limit. |

| Running a Red Light | 4-6 | Failing to stop at a red traffic signal. |

| Following Too Closely | 2-4 | Maintaining an unsafe distance behind the vehicle in front. |

| Failure to Signal | 1-3 | Not using turn signals properly when changing lanes or turning. |

| Improper Lane Change | 2-4 | Changing lanes without properly checking for other vehicles. |

| Driving Under the Influence (DUI) | 7+ | Operating a vehicle while impaired by alcohol or drugs. This is a serious offense with potentially severe consequences. |

| Reckless Driving | 6+ | Driving in a manner that demonstrates a disregard for safety or the safety of others. This often involves multiple violations. |

Sources of DMV Points

Receiving points on your driver’s license can have a significant impact on your driving privileges and insurance costs. Understanding the reasons behind these points is crucial for responsible driving. Knowing which actions lead to point accumulation helps drivers avoid costly mistakes and maintain a clean driving record.DMV points are assigned for a variety of driving-related offenses. These points are a tangible representation of a driver’s record, reflecting their adherence to traffic laws and safe driving practices.

The accumulation of points can affect your ability to obtain or maintain insurance coverage, and in some cases, can lead to license suspension or revocation.

Common Reasons for DMV Points

A driver’s record is a valuable reflection of their commitment to safe driving. Understanding the specific behaviors that lead to points is essential to maintaining a clean record. Traffic violations, accidents, and other offenses all contribute to point accumulation.

Traffic Violations Leading to DMV Points

Traffic violations are a primary source of DMV points. These violations often stem from a driver’s failure to follow established traffic laws and regulations.

- Speeding is a frequent source of points. Exceeding the posted speed limit, even by a small margin, can result in points. For example, driving 15 mph over the limit in a school zone could lead to a significant point deduction.

- Running red lights or stop signs is another common violation. These actions can be extremely dangerous, and are often associated with serious accidents. Failing to yield the right of way can lead to points, as well as other serious consequences.

- Following too closely or tailgating another vehicle is often cited as a traffic violation. It demonstrates a lack of consideration for other drivers and creates a hazardous driving environment.

- Improper lane changes and unsafe turns can lead to points. These violations often occur due to a driver’s lack of attention or carelessness.

Accidents and Other Offenses Contributing to Point Accumulation

Accidents, regardless of fault, can lead to DMV points. Other offenses, such as reckless driving or driving under the influence (DUI), are also associated with significant point accumulations.

- Accidents, even minor ones, can result in points. While the specific circumstances and severity of the accident will influence the number of points assigned, any accident often results in some point accumulation.

- Reckless driving, including aggressive maneuvers, or driving under the influence (DUI) are serious offenses that result in substantial point deductions. Driving under the influence of drugs or alcohol poses an immediate threat to public safety.

- Failing to maintain your vehicle’s required safety features, like functioning headlights or brake lights, can also lead to points.

Examples of Driving Behaviors Resulting in DMV Points

Certain driving behaviors can directly lead to the accumulation of DMV points. Understanding these examples helps drivers make informed decisions to avoid violations.

- Ignoring traffic signals or signs can lead to points.

- Failing to yield to pedestrians in designated crosswalks is a common violation that can result in points.

- Using a cell phone while driving, without the use of a hands-free device, is a major contributor to point accumulation.

- Disregarding parking regulations, like exceeding the time limit, can result in points.

DMV Violation Point Table

This table illustrates various violations and their corresponding point values. Keep in mind that specific point values can vary by jurisdiction.

| Violation | Points | Impact |

|---|---|---|

| Speeding (1-15 mph over limit) | 2-4 | Increased insurance premiums, potential license suspension |

| Running a red light | 4-6 | Significant increase in insurance premiums, potential license suspension |

| Driving under the influence (DUI) | 8-12 | License suspension, criminal charges, substantial insurance increase |

| Reckless driving | 8-12 | License suspension, criminal charges, substantial insurance increase |

| Following too closely | 2-3 | Increased insurance premiums, potential license suspension |

Impact of Points on Insurance Premiums

Insurance points, whether from the Department of Motor Vehicles (DMV) or your insurance company, can significantly affect your car insurance premiums. A single incident can lead to increased costs, and multiple offenses can result in substantial financial burdens. Understanding this relationship is crucial for responsible driving and managing insurance expenses.Accumulating points on your driving record, whether through traffic violations or accidents, directly correlates with increased insurance premiums.

Insurance companies use this data to assess risk. Drivers with a history of points are considered higher-risk, justifying higher premiums to offset potential payouts.

Relationship Between Points and Premium Increases

Insurance companies employ actuarial models that consider various factors, including the number and type of points accrued. These models analyze the probability of future claims based on driving history. Drivers with more points are more likely to file a claim, potentially causing greater financial loss to the insurance company. This is why insurers increase premiums for drivers with a history of points.

Potential Premium Increases, Insurance points vs dmv points

The precise amount of premium increase varies greatly. Factors like the type of insurance policy, the driver’s age, the vehicle’s make and model, and the specific insurance company all play a role. However, a general trend emerges, where the more points accumulated, the greater the potential increase in premiums.

| Point Level | Potential Premium Increase Percentage |

|---|---|

| 1-3 Points | 5-15% |

| 4-6 Points | 15-25% |

| 7-9 Points | 25-35% |

| 10+ Points | 35%+ |

Example: A driver with a clean record might pay $150 per month for insurance. If they accrue 4 points, their premium could increase by 15-25%, potentially reaching $180-$190 per month. Similarly, 10+ points could result in a premium increase of 35% or more, dramatically impacting the monthly cost. It is important to note that these are estimates and actual increases will vary.

Impact of Points on Driving Privileges

Accumulating points on your driving record can have serious consequences beyond just higher insurance premiums. These points can directly impact your driving privileges, potentially leading to license suspension or restrictions. Understanding these repercussions is crucial for maintaining safe driving habits and avoiding unnecessary issues.Your driving record is a reflection of your driving behavior. A clean record demonstrates responsible driving practices, while accumulating points signals a pattern of potentially risky or unsafe behavior.

The severity of these consequences depends heavily on the number of points accrued and the specific state’s regulations.

Effect of DMV Point Accumulation on Driving Privileges

DMV points, when accumulated, can result in a variety of restrictions and suspensions on your driving privileges. These actions are typically designed to encourage safer driving habits and to protect the public. Points are not just a number; they are a marker of driving behavior.

Examples of Potential License Suspension or Restrictions

Depending on the number of points accumulated, you might face temporary suspensions or restrictions on your driving privileges. A common example is a temporary license suspension for a certain period, during which you are prohibited from operating a motor vehicle. Further, restrictions can involve limitations on the hours you can drive, or restrictions on the types of vehicles you can operate.

These restrictions are put in place to safeguard public safety. For instance, a driver with multiple moving violations may face a suspension of their license, prohibiting them from driving until the violation is resolved. This is a significant step designed to prevent further incidents.

Duration of Suspension or Restrictions

The duration of license suspension or restrictions varies widely based on the number of points accumulated and the specific regulations of the state. There’s no single answer; it depends on individual circumstances and the number of points accumulated. Some states have specific timelines for suspensions or restrictions, others consider the severity of the offense in addition to the number of points.

In general, the more points accumulated, the longer the suspension period will be. This reflects a clear correlation between the severity of offenses and the duration of the penalty.

Table Outlining Possible Consequences of DMV Point Accumulation

| Point Level | Potential Consequences |

|---|---|

| 3-5 Points | Warning, potential court appearance, increased insurance premium. |

| 6-9 Points | Temporary license suspension, possible restrictions on driving hours or vehicle type. |

| 10+ Points | Longer license suspension, possible license revocation, higher insurance premiums, and potentially more severe legal consequences. |

Accumulating points on your driving record is a serious matter with consequences extending beyond just insurance premiums. Understanding the impact on driving privileges is crucial for responsible driving habits.

Comparing Point Systems

Understanding both insurance and DMV points is crucial for responsible driving. Knowing how these systems work and the potential consequences of accumulating points helps drivers make informed decisions about their driving habits and maintain a clean driving record.The insurance point system and the DMV point system are distinct but interconnected. Both systems aim to encourage safe driving practices, but they differ in their scope and how they penalize or reward drivers.

While both can affect your driving privileges and finances, they operate under different rules and have varying impacts on your daily life.

Insurance Point System

Insurance companies use points to assess risk and adjust premiums. Drivers with a higher risk profile are assigned higher premiums, potentially increasing the cost of insurance. This system often considers factors like accidents, violations, and moving violations. The severity of infractions directly correlates to the number of points assigned.

DMV Point System

The DMV point system is designed to track driving infractions and maintain safe roads. The system typically assigns points based on the severity of the violation, which can include speeding, reckless driving, and other offenses. The accumulation of points can result in the suspension or revocation of driving privileges, which can have serious repercussions on a driver’s personal and professional life.

Similarities and Differences

Both systems aim to encourage safe driving practices. However, they differ significantly in their purpose, scope, and consequences. Insurance points primarily affect insurance premiums, while DMV points directly impact driving privileges. A driver with multiple points on their record could face higher insurance costs, and also potentially lose their driving license, making both systems important to understand.

Consequences of Accumulating Points

Accumulating points in either system can have severe consequences. For example, a driver with a high number of insurance points might face a substantial increase in insurance premiums, potentially making car insurance unaffordable. Likewise, accumulating DMV points can lead to license suspension or revocation, restricting the driver’s ability to commute, work, and participate in everyday life.

Comparison Table

| Feature | Insurance Points | DMV Points |

|---|---|---|

| Purpose | Assessing risk and adjusting insurance premiums. | Tracking driving infractions and maintaining road safety. |

| Scope | Limited to insurance companies. | Applies to all drivers in the state. |

| Impact on Finances | Higher premiums for drivers with more points. | Potentially no direct financial impact, but the loss of driving privileges can create significant financial hardship. |

| Impact on Driving Privileges | No direct impact on driving privileges, but high point accumulation can result in higher insurance premiums, which might make driving less affordable. | Suspension or revocation of driving privileges for excessive points. |

Recovering from Points

Clearing insurance and DMV points can feel like climbing a mountain, but it’s achievable with the right approach. Understanding the specific avenues for reducing or removing these points is crucial for regaining driving privileges and affordable insurance. Patience and proactive steps are key to successful point removal.

Methods for Reducing Insurance Points

Insurance companies often offer various options to help drivers reduce or remove points. These options may include completing defensive driving courses, demonstrating improved driving behavior, or proving a history of safe driving. Insurance companies usually provide specific details on their policies regarding point reduction. Drivers should always check their specific insurance policy for details.

Yo, insurance points vs DMV points, right? It’s all about avoiding those pesky fines, especially when you’re tryna avoid a ban. Like, you know, if you’re needing to donate blood at a place like blood bank cleveland memphis tn , you don’t wanna be racking up the points, or it’ll all go pear-shaped. So, keep those points low, you know?

Gotta stay legal, keep it fresh.

- Defensive driving courses: These courses equip drivers with skills to avoid accidents and react appropriately to challenging situations. Successful completion can often lead to a reduction in points. For example, a driver who completes a defensive driving course might see a reduction in their insurance points, potentially lowering their premium.

- Improved driving behavior: Sustained safe driving habits, demonstrated through a clean driving record, can influence insurance companies to reduce or remove points. A driver with a history of avoiding traffic violations and accidents might have points removed from their insurance record.

- Proof of safe driving history: Some insurance providers consider factors like a history of safe driving when deciding whether to reduce or remove points. This could involve providing detailed driving records or accident-free statements. A driver who hasn’t accumulated any traffic violations in the past few years may see their insurance points reduced.

Steps to Remove Accumulated DMV Points

DMV point removal procedures vary by state and offense. Drivers should contact their local DMV office for precise information. Often, specific actions are required to resolve or remove accumulated points.

- Contact your local DMV: Begin by contacting the Department of Motor Vehicles (DMV) in your state to understand the process for removing accumulated points. DMV representatives can provide detailed information about the requirements for removing points, including necessary forms and deadlines.

- Address the underlying violation: In many cases, removing DMV points hinges on resolving the violation that led to the points. This could involve paying fines, completing community service, or attending a specific program. For example, a driver with points due to a speeding ticket might need to pay the fine and attend a traffic school to clear the points.

- Complying with DMV requirements: Thoroughly follow all the steps and guidelines set by the DMV. This might include submitting necessary paperwork, attending hearings, or complying with specific court orders. Adherence to the guidelines is critical to successfully removing points.

Factors Influencing Point Removal Efforts

The success of removing points hinges on several factors, including the nature of the violation, the driver’s driving history, and the state’s specific regulations. Consistent safe driving behavior can greatly improve chances of point reduction.

- Nature of the violation: The severity of the violation plays a significant role in the difficulty of point removal. Minor violations might be easier to clear than more serious offenses. For instance, a driver with a minor infraction like a parking ticket might have a much easier time clearing points than someone with a DUI.

- Driver’s driving history: A clean driving record before the violation can influence the DMV’s decision. A driver with a consistent history of safe driving may have a better chance of having points reduced or removed.

- State regulations: State regulations significantly impact the point removal process. Different states have varying rules and procedures for dealing with traffic violations and clearing points. This should be thoroughly researched by the driver.

Summary Table: Steps for Point Removal

| Point Type | Removal Method | Eligibility Criteria |

|---|---|---|

| Insurance Points | Defensive driving courses, improved driving behavior, proof of safe driving history | Completion of courses, consistent safe driving, clean driving record |

| DMV Points | Resolving the underlying violation, complying with DMV requirements | Payment of fines, completion of community service, adherence to court orders |

Prevention of Point Accumulation

A clean driving record is invaluable. It not only protects your driving privileges but also safeguards your insurance premiums. By understanding and practicing safe driving habits, you can significantly reduce the risk of accumulating points on your record.Safe driving isn’t just about avoiding accidents; it’s about responsible decision-making on the road, every time. This involves a proactive approach to road safety, prioritizing safety over speed, and always being mindful of others.

Safe Driving Practices

A proactive approach to safe driving reduces the likelihood of receiving points. This includes adherence to traffic laws, anticipating potential hazards, and maintaining a safe following distance.

Responsible Driving Behaviors

Responsible driving behaviors are essential for avoiding points. These include maintaining a safe speed, paying attention to your surroundings, and avoiding distractions like cell phones or eating while driving. Remember, every action on the road affects those around you.

Maintaining a Clean Driving Record

Maintaining a clean driving record is a continuous effort. It involves consistent safe driving practices, a commitment to following the law, and understanding the implications of accumulating points.

Importance of Following Traffic Laws and Regulations

Understanding and consistently following traffic laws and regulations is crucial. Ignoring these rules can lead to costly consequences, including points on your driving record.

Safe Driving Tips

Consistent adherence to safe driving practices can prevent point accumulation. This involves more than just reacting to situations; it requires proactive decision-making to avoid potential hazards.

| Tip | Description | Benefit |

|---|---|---|

| Maintain a Safe Following Distance | Allow enough space between your vehicle and the vehicle in front to react to unexpected situations. | Reduces risk of rear-end collisions and allows for quicker responses to hazards. |

| Obey Speed Limits | Adhere to posted speed limits in all conditions. Speed limits are determined by the conditions and safety of the road. | Reduces the likelihood of speeding tickets and improves reaction time in case of sudden changes in traffic. |

| Avoid Distracted Driving | Put away cell phones, avoid eating or drinking while driving, and focus solely on the road. | Improves awareness and reaction time, minimizing the risk of accidents and associated points. |

| Be Aware of Your Surroundings | Constantly scan the road ahead, paying attention to other vehicles, pedestrians, and cyclists. | Enables proactive response to potential hazards, allowing for adjustments in driving behavior to avoid incidents. |

| Use Turn Signals Correctly | Signal your intentions clearly and predictably, indicating turns and lane changes. | Improves the visibility of your vehicle’s movements, promoting safer driving and reducing the chance of accidents. |

| Yield to Pedestrians and Cyclists | Always give the right of way to pedestrians and cyclists, especially in crosswalks and bike lanes. | Ensures the safety of vulnerable road users and prevents potential incidents, contributing to a clean driving record. |

Concluding Remarks

In conclusion, understanding the distinctions between insurance and DMV points is vital for responsible driving. By familiarizing yourself with the rules and consequences, you can proactively manage your driving record and avoid costly repercussions. The guide has offered a comprehensive comparison, highlighting the similarities and differences between these two systems and providing insights into mitigating the impact of points.

Ultimately, safe driving practices are paramount in maintaining a clean driving record and safeguarding your financial and driving privileges.

Essential FAQs: Insurance Points Vs Dmv Points

What are the most common reasons for getting insurance points?

Common reasons for receiving insurance points include speeding tickets, moving violations, and accidents. The severity of the violation determines the number of points assigned.

How do DMV points affect my driving privileges?

Accumulating DMV points can lead to license suspensions or restrictions. The duration of these actions depends on the number of points accumulated and the specific regulations of your state.

Are there specific steps for removing insurance points?

Yes, there are specific methods for reducing or removing insurance points. These methods vary by state and insurance company. Good driving habits and a clean driving record often help to improve your insurance rating.

What are the potential consequences of accumulating DMV points?

Accumulating DMV points can result in license suspension, restrictions on driving, and increased difficulty in obtaining new licenses. The severity of the consequences depends on the accumulated points and the regulations of the state.